Are our CPF monies our monies?

Where are our CPF monies?

We only see numbers on the CPF website or app. No debit card or means to withdraw before age 55.

Even upon reaching age 55, many could not withdraw much CPF monies due to not meeting the minimum sum requirement.

These are the common dilemna people face.

Let me try to address and convince ourselves on these doubts in this post.

Official source from

Factually explains that CPF monies are invested by the CPF Board in Special Singapore Government Securities (SSGS). SSGS are issued specially by the Government to CPFB.

In my opinion, I interpret that CPFB "lent" or "passed" our CPF monies to the Government. An "IOU" (an informal 'I Owe You' document acknowledging debt) was signed in the form of a special bond called SSGS.

In a way, CPFB is the trustee of our CPF monies, which are used to buy special "IOU" bonds that pay us our 2.5% and 4% interests in our CPF OA and SA, MA or RA savings accounts respectively.

Our next question is: What and how does the Government deal with the CPF monies?

The proceeds from SSGS are pooled with the rest of Government funds, such as Government surplus, and proceeds from land sales.

The co-mingled funds are invested by the Government's fund manager, GIC, for long-term returns.

GIC was incorporated in 1981 to invest the government's assets for long-term returns.

CPF monies are not managed by Temasek.

I interpret that our CPF monies are indirectly pooled together with the Government monies to become the war chest that GIC use to invest for the long-term to generate returns.

Many people are unhappy about our CPF monies becoming the "Government's monies", missing out the "IOU" bond part which pays attractive bonds interests in return.

Not everyone is comfortable with own own CPF monies being lent to others to invest without our consent.

However, we have to understand that if CPFB merely keeps our CPF monies and do nothing, will be be able to earn 2.5% or 4% interests? Our monies will be eroded by inflation over time. $1 becoming 50 cents by the time we retire.

In a nutshell, our CPF monies are trusted to CPFB and indirectly managed by GIC.

Let us move a step further to investigate how and what does GIC invests in, using "our CPF monies" and/or "the Government's monies".

According to the FAQ page on GIC website, GIC is a fairly conservative investor, with a globally diversified portfolio spread across various asset classes. Most of the investments are in the public markets, with a smaller component in alternative investments such as private equity and real estate.

From the GIC Annual Report 2021, this table shows the asset mix of GIC's investment portfolio.

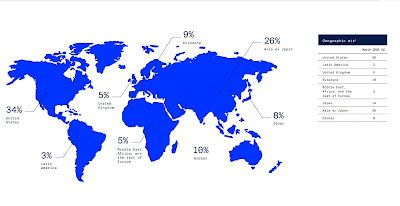

The geographical distribution of the GIC portfolio as at 31 Mar 2021 is shown below. Investments in US and Asia excluding Japan make up 60%.

These high level info are not enough to satisfy our curiosity.

I am interested to find out specifically which US stocks do GIC invest or wager on.

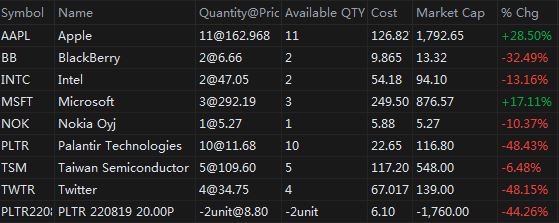

A quick check on whalewisdom.com revealed the top holdings of GIC Pte Ltd based on US Security and Exchange Commission filings.

I am surprised with these unfamiliar (at least to me) names of US listed companies invested by GIC.

More than US$5 billion vested in an American online food ordering and delivery platform, Doorbash Inc. (DASH), more than US$2 billion vested in a midstream energy company, Tallgrass Energy (TGE1), more than US$1.5b vested in a leading global drug development, laboratory and lifecycle management company, PPD, Inc. (PPD), $1.3b vested in a leading China carrier and cloud neutral Internet data center service provider, VNet Group (VNET) and $1.1b vested a diversified environmental services company in GFL Environmental Inc. (GFL).

I am not able to get more details of which Chinese businesses do GIC invest in. But from the Evergrande turmoil, we learnt that GIC has been investing in Chinese Real Estate for the past 2 decades. They are also vested in China bonds.

Hope these have satisfied our curiosities on where our CPF monies went to.

Thanks for reading. GXGX! Happy CNY! HENG ONG HUAT AH!

With Love & Peace,

Qiongster

Disclaimer: This post is written entirely based on my personal opinion and factual findings from credible sources in the Internet and does not constitute any form of recommendation, news nor investment advice.