The month of September 2022 has ended. Let me give an update on my investment portfolios.

My SGX Income Portfolio value falls to $266.2k from $283.5k last month mainly due to the crash of REITs from factoring in the impact of a potential high interest rate of up to 4.5% by end 2022. The share price of REITs need to be compressed to maintain the same risk premium from the higher risk free rate. It is a short-term pain to swallow huge paper losses in just two weeks but nonetheless affirms that my conservative portfolio allocation of 17% cash in bank fixed deposits relative to 32% in Reits and stocks (invested by cash and SRS funds) provides balance and consolation in a high interest rate environment.

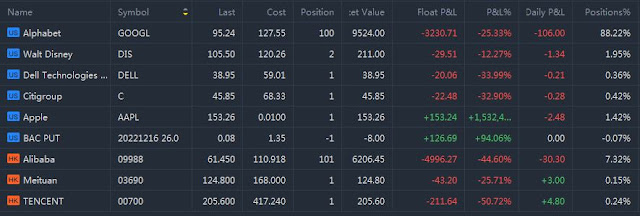

My US/HK Growth Portfolio value drops to US$16.9k from US$19.3k last month due to further weakness of tech growth stocks in the portfolios amidst immense recession and inflation fears.

My SRS Ultra Long-Term Portfolio value plunges to $112.9k from $117.5k mainly due to the crash of Keppel DC Reit, Keppel Reit and Wilmar.

S$25k shed this month!

Fret not, I still sleep soundly with a peaceful mind every night.

This is because I did not leverage on my investments nor have any liabilities affected by higher interest rates. I invested what I could afford to lose. I remain employed with active monthly income while my investments are positioned for the long-term and I would not have sold them even if they soar to the skies.

The path towards achieving financial freedom will be rugged and not be smooth sailing all the time. I sense opportunities in a sea of crisis and noises instead. I plan to continue investing in REITs and tech stocks while subscribing to Singapore Savings Bonds and placing cash in fixed deposits in the months to come.

Portfolio Actions

1. Bought 5,000 shares of Frasers Centrepoint Trust at $2.26.

2. Sold 1 unit of Alphabet Inc, GOOGL221007 call option with $108 strike price at US$0.38

3. Sold 3 units of Palantir Technology Inc, PLTR221007 call option with $8.5 strike price at US$0.11.

Portfolio Dividends

1. Received $119.50 of dividends from Savings Bonds on 1 Sep.

2. Received $188 of dividends in SRS from ST Engineering on 2 Sep.

3. Received $787.30 of dividends from Ascendas Reit on 5 Sep.

4. Received $939.60 of dividends from Capland Int Com Trust on 9 Sep.

5. Received $403.92 of dividends in SRS from Keppel DC Reit on 9 Sep.

6. Received $286.80 of dividends as 109 shares from Mapletree Industrial Trust DRP on 9 Sep.

7. Received $226.80 of dividends from Mapletree Logistics Trust on 9 Sep.

8. Received $211.31 of dividends as 182 shares from Capland China Trust DRP on 22 Sep.

9. Received $729.60 of dividends from AIMS APAC Reit on 23 Sep.

10. Received $42 of dividends from OUE Limited on 29 Sep.

SGX Income Portfolio

Portfolio Value = $266.2k

US/HK Growth Portfolio

Moomoo

Tiger Broker

Total Portfolio Value = US$16.9k

SRS Ultra Long-Term Portfolio

Thanks for reading. Stay focused and remain steadfast as always!

With love and peace,

Qiongster