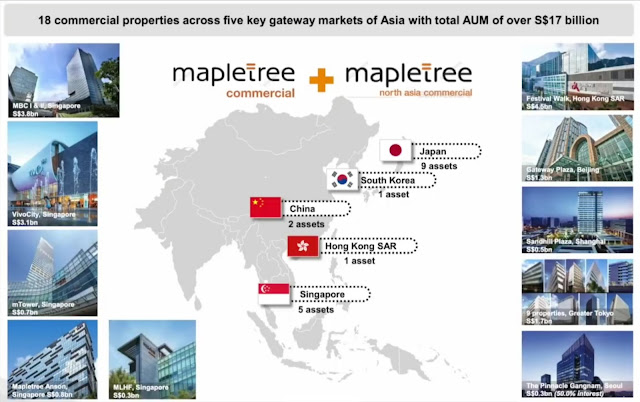

On 31 Dec 2021, Mapletree Commercial Trust (MCT-SGX:N2IU) and Mapletree North Asia Commercial Trust (MNACT-SGX:RW0U) proposed a merger into a combined entity with market cap valued at more than S$10 billion theoretically, to become the 7th largest Reit in Asia.

Let us zoom into the 5 positives of this merger.

1. DPU and NAV Accretive

From the announcement, the DPU will increase by at least 7.5% from 4.39 cents to 4.72 cents per half year and the NAV per unit of MCT will increase by at least 6.5% from $1.68 to $1.79 after the merger.

2. Geographical Diversification

MCT currently owns only properties in Singapore including the likes of Vivo City and MBC I & II.

MNACT currently owns properties in Hong Kong (Festive Walk Mall constituting 53.5% of the portfolio), China, Japan and South Korea.

After the merger, the enlarged entity will own all the properties currently owned by MCT and MNACT, achieving geographical diversification as follows: Singapore (51.4%), Hong Kong (26%), China (10.8%), Japan (10.2%) and South Korea (1.6%).

3. Top 10 Largest Asian Reit

By becoming the 7th largest Asian Reit, the enlarged entity will enjoy enhanced free float, trading liquidity and increased index representation.

As Reits depend heavily on debts to fund operations and acquisitions of properties, the enlarged Reit will also be able to leverage on close to $4 billion of debt funding capacity, at lower cost of debt to achieve greater financial flexibility.

4. Lowered Tenant Concentration Risk

Following the merger, there will be improved cashflow stability from high quality tenants while reducing income concentration. For example, Google's is MCT's top tenant and its 10.8% contribution to MCT's gross rental income will drop to 5.8% of MPACT's gross rental income; BMW is MNACT's top tenant and its 8.1% contribution to MNACT's gross rental income will drop to 3.8% of MPACT's gross rental income after the merger.

5. Growth Potential

MCT has been experiencing stifled growth since the acquisition of MBC II in 2019. They have 6 right of first refusal properties from the sponsor, Mapletree Investments Pte Ltd for potential acquisition - Harbourfront Centre, Harbourfront Tower 1 and 2, St James Power Station, PSA Vista and SPI Development Site. None of the 6 properties present any "wow" factor.

MNACT, on the other hand, has the mandate to acquire any commercial and retail properties spanning across North Asia from South Korea, Japan to all over China for inorganic growth.

MPACT will be able to amalgamate the strengths of both Reits, leveraging on economies of scale, continue to achieve increasing annual DPU and growth in property assets via larger acquisitions, capital recycling, asset enhancement initiatives and development initiatives.

After seeing the beautiful story of merger, let us look at the cons and downsides of this merger.

1. Greater Risks

With geographical diversification of the property portfolio, it comes with greater risks. Forex risks from converting rental income received from various currencies back to SGD, natural disasters, political unrest and regulatory risks particularly from the China government just to name a few. Higher risks should give higher returns hence we should expect a higher dividend yield of more than 5% to compensate for the greater investment risks.

2. Pollution of Greater Southern Waterfront Pure Crown Jewels

MCT will no longer be able to boast about owning pure high quality office/business park/retail properties such as the likes of America Merill Lynch Harbourfront (MLHF), MBC I & II and Vivocity, situated in Southern Singapore to ride on the waves of Greater Southern Waterfront in Singapore.

The scenes of protestors burning down Christmas Trees in Festive Walk Mall in Kowloon, Hong Kong and empty retail spaces in Gateway Plaza, locked-down Beijing City in China will pollute the scenes of crowded and joyous shoppers in Vivocity in Harbour front and conduciveness of MBC I & II or MLHF for work and play.

Festive Walk and Gateway Plaza are the underperforming properties in MNACT's portfolio with negative rental reversions, short lease, shorter WALE and high vacancies that may bring down the entire enlarged entity and drag down MPACT's performance in terms of DPU growth and attractiveness. MPACT will need to make many more high quality acquisitions in Japan and Korea before disposing these 2 underperforming assets at possibly losses.

3. Increased Gearing and Higher Debt Ratio

Gearing of MCT will increase from 33.7% to 39.2% post merger. In contrast, gearing of MNACT will decrease from 41.4% to 39.2%. Evidently, this deal is to save MNACT's ass, rather than to boost MCT's growth prospects.

Due to the high gearing, equity fund raisings are highly probable after the merger to raise funds for acquisitions, operations or other initiatives.

It is hence no surprise that Moody is reviewing MCT's Baa1 issuer rating for a downgrade to reflect the potential weakening of MCT's credit metrics and uncertainty around its financial policy following the proposed merger with MNACT. On a pro forma basis, Moody expects MCT's expected net debt to increase to around 9.4 to 9.9 times Ebitda from 8.2 times for the year ending Mar 2022. This is weaker than the 8.5 times downgrade threshold for Baa1 rating.

Plan

We have to ask ourselves the original purpose of our investment in MCT or MNACT.

Is it for income, for growth, for value, for capital gain or for trading short-term to punt?

What roles do these Mapletree Reits play in your investment portfolio?

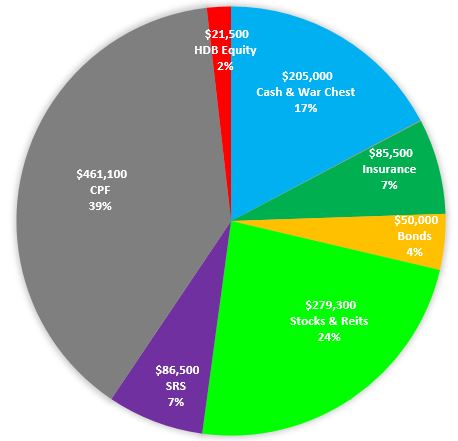

I invested in MCT primarily to own high quality, income-producing commercial assets yielding more than 4% for the long-term.

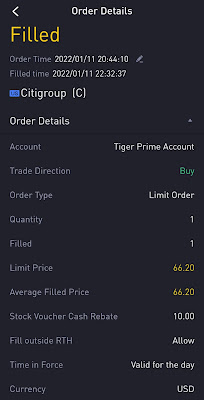

My trade of MNACT in 2020 was a short-term value punt using idle SRS funds. I bought at 0.95 which was a great discount to NAV, collected 0.02 of dividends and disposed at 0.935, breaking even. I do not own any MNACT shares now but with the benefit of hindsight, I should have kept it till now.

I am currently vested in 11,000 shares of MCT and I intend to do nothing to existing shares till merger since MPACT is able to continue fulfill my objective of long-term income at more than 4% yield.

I will add shares of MCT should the opportunity arise when its share price fall below my assessment of fair value. Let us try to gauge what is the fair value of MCT, assuming the merger took place and MCT will become MPACT given the higher risks.

The dividend yields of MNACT in 2017, 2018, 2019, 2020 and 2021 are 6.83%, 6.95%, 7.13%, 5.61% and 6.17% respectively. We know that in 2020, the rental income is affected by the pandemic and things started to recover slightly in 2021 last year. I believe it is fair to demand an average yield of 7% from the properties of MNACT during pre and post pandemic days.

The dividend yields of MCT in 2017, 2018, 2019, 2020 and 2021 are 4.92%, 4.96%, 5.4%, 3.79% and 5.31% respectively. Again we know that in 2020, the rental income is affected by the pandemic and things started to recover slightly in 2021 last year. I believe it is fair to demand an average yield of around 4% from the Singapore properties of MCT during normal times.

After the merger, for MPACT, we could demand 51% of 4% and 49% of 7% to derive a yield of 5.47% yield to compensate for the greater risk from investing our monies in this enlarged entity.

Assuming we get an annual dividend of 4.72 cents x 2 = 94.4 cents or $0.0944 from MPACT. The share price of MPACT needs to be $1.725 and below to give us a minimum yield of 5.47%.

At current share price of MCT at $1.83, the yield based on $0.944 dividend is 5.16% which is quite attractive but not enough to compensate for the greater risks.

I plan to add more shares to increase my investment of MCT if its share price fall below $1.73. In fact, I am willing to pay a slight premium of 1 to 2% to get a slightly lower yield of around 5.3% in current low interest rate environment and start placing my order at $1.76.

If I am still vested in MNACT shares and if it constitute more than 10% of my investment portfolio, I would consider selling the shares above $1.10 because its value is pretty much unlocked from the news of this merger, or opt for option 2 to receive payout of $0.1912 in cash and 0.5009 new Mpact share based on per share of MNACT owned. I will then deploy the cash into other growth stocks or Reits.

If MNACT only constitutes a small portion i.e. <10% of my portfolio, I would let nature takes its course and do nothing. By default, every MNACT share will be converted to 0.5963 Mpact share after merger.

Conclusion

This proposed merger is a bad one for MCT shareholders but the intentions are good at a macro level.

The enlarged entity MPACT is still worth investing into, for owning Asian commercial properties for income and growth, but at the fair price to compensate for the higher risks, which I believe to be below $1.73.

Thanks for reading. Stay safe and strong always.

With Love and Peace,

Qiongster