Saturday, June 24, 2023

Passive Income in 2Q and 1H 2023

Wednesday, June 21, 2023

Subscribed to Aims Apac Reit Preferential Offering

After sharing my plan for Aims Apac Reit Preferential Offering, I did not manage to add any shares of AA Reit before Ex-Dividend and Ex-Right date.

Even though the share price of AA Reit continue to weaken and even hit a low of $1.16 before rebounding to above $1.20, I missed the opportunity as I procrastinated for too long.

AA Reit is the largest constituent at 12% of my SGX Income Portfolio. I currently own 32,000 units of AA Reit at a net cost of $0.80 after factoring in all the cumulative dividends collected.

I have been waiting for a good opportunity to increase investment in this Reit since my last addition at $1.18 in Sep 2020 and the time could not be any better than now.

Now that the preferential offering (PO) is ongoing, I subscribed for 3,000 shares (inclusive of excess) of AA Reit at PO price of $1.189 today, hoping to get all.

I tried Paynow via scanning QR code in CDP website but hit by Paynow limit of $1k and requires 12 hours for adjustment to take place, so I went to press in ATM. $2 admin fee applies for both means but it is more convenient to use Paynow.

There it goes.

My investment in AA Reit is positioned for the long-term, at least the next decade. It is hard to believe that I have collected more than $13k of dividends from AA Reit alone in the past 7 years.

In the coming months, years and decade to come, I hope to enjoy more dividends from AA Reit perpetually effortlessly.

Saturday, June 17, 2023

Net Worth Update June 2023

S$1.47m

My net worth increases to $1.47m mainly due to a rebound in my investment portfolios and cash flow from salary, CPF savings and dividends in the past weeks.

The Fed has calmed down market nerves by holding off on rate hike but hinted at 2 potential hikes by end of 2023 but I believe the stock markets will remain volatile and choppy for the coming months.

CPF savings form one-third bulk of my wealth. I have already achieved full retirement sum in CPF SA and topped up my Medisave account to the basic healthcare sum of $68.5k early this year.

My stocks and Reits constitute around a quarter of my net worth after I injected another $16k into Mapletree Logistics Trust and rotated Sembcorp Industries into DBS this month. I plan to continue adding high quality S-Reits or local bank stocks to my SGX income portfolio when the opportunity arises. For US or HK stocks, I will not increase exposure but just dabble with options to collect premiums.

My cash and war chest drops to 18% of my net worth. In the current high interest environment, my cash is being stashed away in bank fixed deposits yielding more than 3% p.a., in Fullerton cash funds under custody of Moomoo and Tiger Broker, and in Money Market Funds held by Phillips Capital yielding around 3.5% p.a. with interest paid daily.

SRS forms 8% of my wealth and I have already completed the top up of $15.3k annual limit for 2023. I have also deployed the new SRS funds to increase my investment in OCBC amidst fear and uncertainty in bank stocks after the collapse of several US banks since Mar 2023. After emptying my SRS funds in Mar 2023, it self replenished to around $3k due to dividends collected from ST Engineering, OCBC, Wilmar, Keppel DC Reit, Keppel Reit and Comfortdelgro in the SRS ultra long-term portfolio.

7% of my net worth is in risk-free Singapore Savings Bonds ($110k) and relatively low-risk Astrea 7A PE bond ($9k). I have redeemed an old tranche (SBAPR19 GX19040X) yielding 2.12% last month and the funds which came in early this month were injected into MLT. I have also abandoned the plan to continue subscribing to Singapore Savings Bonds for the rest of the year as they yield below 3% for the recent 2 tranches and I forsee the yield shall stay below 3% for the coming months.

I deployed my financial assets conservatively and allocated almost 62% to low-to-no risk assets:

a. CPF (37%)

b. Cash (18%)

c. Risk-free bonds (7%)

The higher-risk assets are at 38% and given a long time frame to generate passive income or grow.

d. Equities (24%)

e. SRS (deployed largely into equities) (8%)

This provides a huge defensive safety net but the opportunity cost is that my net worth will not grow as fast and furious but slow and steadily. I may reduce my low-to-no risk ratio to 60% as I decided to my risk appetite.

My target net worth by the end of 2023 of at least S$1.45m is already hit so now I target for S$1.5m with an annual passive income of S$22k.

Life is exciting in a post pandemic world. Ignore the noises. Remain on track. Be greedy when others are fearful. Be hungry when others are contented. Live everyday to the maximum! En route to financial freedom!

Friday, June 16, 2023

Earn Miles from Nation Building

It is the heart wrenching time of the year when typical wage slaves receive Notice of Assessment from Taxman IRAS in Singapore.

I received an SMS days ago notifying me on the due date for my liable taxes.

In the past, I would use CitiPayall to clear my taxes using Citibank Premiermiles card to earn miles.

However for this year, the admin fee is higher at 2.2% for a higher earn rate of 2.2miles per dollar with a minimum spend of $8k.

As my taxes are below $8k, I decided to explore alternative platform such as ipaymy to pay my taxes and earn miles at the same time. Its admin fee is lower than Citibank at 1.75% for me to earn miles albeit at lower rate of 1.2miles per dollar.

I am prepared to forgo most of my next month's income for these taxes.

There it goes!

While feeling heartache, the consolation is to be able to accumulate some miles towards my future trip to London and contribute to nation building at the same time!

This is not a sponsored post but merely some ranting for me to share how I deal with one type of certainty in life - tax. The other certainty is death.

Thanks for reading. Stay focused and remain steadfast as always!

Thursday, June 08, 2023

Doubled Up on Mapletree Logistics Trust

I decided to go for the latter and today my order for MLT was filled at $1.63 for 10,000 shares. I will now own 20,000 shares, doubling up on my current holdings.

MLT has launched a private placement recently in Apr 2023 at $1.649 per unit to raise S$200m to acquire 8 logistics properties in Japan, Australia and South Korea for S$913.6m, while keeping its gearing below 40%. This is a yield accretive acquisition amidst higher interest costs

I am happy that my purchase cost is slightly below the private placement price of $1.649 paid by the big boys and at 16% above its book value of $1.43. Projecting an annual dividend of $0.09 per unit, the dividend yield is around 5.5%, which is rather decent for a top quality logistics REIT.

This price is also much lower than the $1.69 paid by Blackrock in Feb 2023 to add 1.8m shares for S$3m.

I believe MLT is a resilient, robust REIT which thrives on the booming and growth of e-commerce and logistics demands in the APAC regions. It is a long-term investment for me to generate steady and consistent passive income for many years to come.

See related posts:

Added Mapletree Logistics Trust in first investment of 2021

Applied for Mapletree Logistics Trust Preferential Offering Shares (2020)

Nibbled Mapletree Logistics Trust and Sembcorp Marine

Wednesday, June 07, 2023

Initiated Position in World's Best Bank

Today I decided to initiate a small position in DBS (SGX:D05).

This is to recycle the capital I received from divestment of Sembcorp Industries yesterday.

DBS is the world's best bank and currently it yields around 5% despite at more than 40% above book value at $21.

Ideally I would like to get DBS at below $30 per share however my fingers are itchy and getting impatient. It is also very difficult to time the market.

Besides, the looming dividends in Aug 2023 are almost certainly guaranteed. I am also eager to replace the great business I disposed yesterday with another great business and I believe DBS is the best candidate to replace Sembcorp Industries in my SGX income portfolio for the long-term.

DBS has a great track record of rewarding shareholders consistently and steadily with growing dividends and capital gains over the past decades. It should continue to do well in this sustained high interest rate environment clouded by noises and uncertainties.

Should the share price of DBS plummet below $30 or $28 in the short future, I shall add more shares to increase investment in this world's best bank.

Tuesday, June 06, 2023

Sold Sembcorp Industries after 8 years! For whopping 100% Profit!?

The love-hate relationship between me and Sembcorp Industries (SGX:U96) officially ends today.

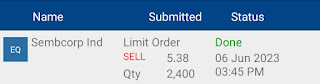

I sold off my paltry 2,400 shares of Sembcorp Industries at $5.38.

In 2015, after switching from a trader to become a novice investor, the first stock on SGX I picked and nibbled was Sembcorp Industries (SCI).

My purchases were 800 shares at $4.18 on 24 Feb 2015, 700 shares at $4.77 on 22 Apr 2015 and 900 shares at $3.15 on 2 Dec 2015. The average holding cost was around $4.00. I made full use of the $10 odd lot (<1000 shares) brokerage promotion after I opened my POEMS account with Philips Securities.

That decision was made after attending many seminars, read many books on value investing, fundamental analysis and so on.

At that time, I believed in the long term prospects of SCI as a global leading energy provision, utilities supply, waste management and urban solutions conglomerate. I thought the regional demands for the services provided by SCI will remain strong and grow perpetually, without taking into consideration that such business is actually cyclical in nature and pose great challenges with high risks.

All my savings for half a year were channeled into SCI due to my strong belief.

It was heartbreaking and disappointing to see the share price of SCI plummet through various levels of supports, reaching lower lows and breaking records every year. It even hit $1.18 during the pandemic in 2020.

I did not bother to average down nor add on to the investment of SCI for the past 8 years, which I collected more than $2.7k worth of dividends including the "free" Sembcorp Marine shares.

However, I also did not cut my losses nor rebalance my portfolio by swapping SCI for other high quality Reit. I executed such portfolio rebalancing moves for my disappointment SingTel, Starhub and SATS.

After factoring in the dividends collected, my net cost for SCI is $2.67. Selling at $5.38 gives a return of slightly more than 100% over 8 years. This is the reward for conviction and loyalty in a great cyclical business.

The fundamentals and main business of SCI have not really changed over the years. Just that it's value was unlocked and the shift in focus towards green renewable energy, together with recent positive catalyst news from capital recycling actions such as divestment of Indian energy division and waste management business SembWaste, propelled the share price of SCI like a rocket for the past year.

I believe it is time for me to recycle my capital and locked in the profits from SCI as nothing goes up forever in this world due to gravity. The funds will go into my warchest for potential reinvestment into local banks or high quality Reits in the coming weeks.

Friday, June 02, 2023

My Plan for Aims Apac Reit Preferential Offering

Optus Centre, Australia owned by Aims Apac Reit

Happy Vesak Day!

I spent this holiday morning strategizing my June 2023 cashflow and thinking about how to deal with the Aims Apac Reit's preferential offering.

On 31 May 2023, Aims Apac Reit (O5RU.SI) announced an equity fund raising of about S$100m, consisting of S$70m in private placements to institutional investors and a non-renounceable preferential offering to existing shareholders for S$30m, at a ratio of 35 units for every 1,000 units owned at $1.189 per unit.

Following the news, the share price of AA Reit tumbled from $1.31 to $1.22 after halt of trading was lifted. This is unthinkable as its share price recently hit $1.43 in May after announcing a strong set of quarterly results and a near-term record quarterly dividend of more than $0.026.

As of 1 June 2023, the private placement has closed at S$1.214 per unit, which is a 6.7% discount to the adjusted volume-weighted average price at $1.30 per unit, after subtracting an advanced distribution of around $0.018 per unit.

The purpose of this fund raising exercise serves to partially or wholly fund asset enhancement initiatives of 2 existing properties in Singapore, redevelopments of properties, potential future acquisitions of properties and to pare down debt to keep its aggregate leverage within the desired range.

I believe the management has considered alternatives such as taking on additional bank loans or issuing bonds in current high interest rate environments and that having an equity fund raising is the most optimal solution in the present landscape. This equity fund raising allows AA Reit to grow its portfolio organically, enhance financial flexibility and strengths, and most importantly, it is an yield accretive action to benefit shareholders.

The sponsor of AA Reit, Aims Apac Capital holdings limited has provided an irrovacable undertaking to the Manager, joint Bookrunners and the Underwriters to showcase their strong support and conviction in AA Reit for the long-term. Excess units not subscribed by existing shareholders will be absorbed by them.

I fully support this equity fund raising even though I am disappointed to see its share price tumble so much in such a short span of time. Amidst fear and uncertainty, I sensed opportunity.

I currently own 32,000 units of AA Reit at a net cost of $0.80 after factoring in all the cumulative dividends collected. I have been waiting for a good opportunity to add on investment in this Reit since my last addition at $1.18 in Sep 2020 and the time could not be any better than now.

In fact since 2016, this Reit has already paid me more than S$13k of dividends!!! This is a greatly managed small industrial Reit which provides consistent and steady passive income to reward loyal shareholders.

Let me briefly share my action plans in the upcoming weeks.

1. Increase investment amidst fear and uncertainty

I will place order queues to buy more than 10,000 shares of AA Reit at below $1.23 next week. At a yield of more than 7% and more than 10% discount off its book value of around $1.35, I believe that this is a great opportunity to increase holdings in AA Reit.

2. Subscribe entitled and excess PO shares

With more holdings, I should be entitled to more Preferential Offering shares. Say if I own 43,000 shares of AA Reit before its ex-Rights date of 8 June 2023, Thurs, I should be entitled to 1,505 shares. Hopefully, with priority given for rounding of odd units, I should be able to get at least 2,000 shares at PO price of $1.189.

3. Sit back, relax, collect the advanced distributions and future dividends

Whether I am successful in increasing my investment in AA Reit or not, I will still be entitled to advanced distributions of between $0.017 and $0.019 per unit after its ex-Dividend date on 8 June 2023 based on my current holdings. These dividends are payable on 20 July 2023. In the coming months, years and decade to come, I hope to enjoy more dividends from AA Reit perpetually effortlessly.