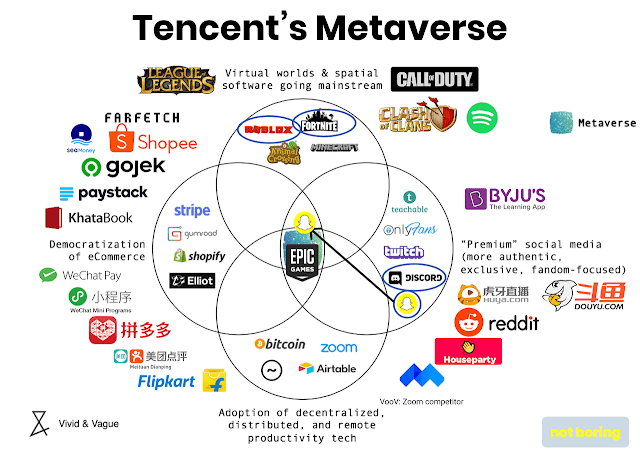

Tencent Holdings Limited (0700.HK) is the largest Chinese technology giant which invests heavily into Metaverse businesses.

Tencent owns a plethora of social media entertainment platforms - Snap (leader in Augmented Reality), Spotify (leading digital music service provider), Doyu (live video streaming service), Reddit (social news aggregation, web content rating and discussion website), Discord (top VoIP digital messaging for gaming community) and WeChat social application which has over 1.25 billion active users.

It is also the largest gaming company in the world and owns Riot Games which makes League of Legends, Epic Games which makes Fortnite running on Unreal Engine platform, Roblox which has more than 150 million active users. Mobiles games that I loved to play from Supercell such as Clash of Clans, Clash Royale and Brawl Stars are all owned by Tencent now.

On the fronts of e-commerce and fintech, Tencent makes its presence felt globally by investing in WeChat Pay (2nd largest Fintech payment provider in China), Pinduoduo (Top agriculture technology platform in China), Paystack (Africa), GoJek (Indonesia), Shopee (Singapore) and so on.

It is hard to imagine Tencent also investing in electric vehicle businesses including the likes of Tesla and NIO.

Thanks to Tiger Brokers Santa Monopoly game event, I managed to get a stock discount voucher to purchase one odd share of Tencent at 10% discount.

I redeemed this voucher today to purchase my first share of Tencent at only around HK$417.

Although this is insignificant, I finally got hold of a trophy share of Tencent to lay the foundation and build up my psychological confidence for future investments into the Metaverse of the future, stepping up from the traditional dividend income investing in SGX Reits.

However, due to regulatory controls by the Chinese government to mitigate Tencent monopolistic instincts, we should see Tencent paring down its stakes in many of the companies it owned. Coupled with its XD of JD shares distribution on 20 Jan, its share price may potentially drop further and experience immense weakness.

If you are interested to kick-start your journey in stock investing in HK or US markets, feel free to use my referral link to register for a Tiger Broker account, fund it with at least S$2k to get a free apple share worth around US$170 and 60 commission-free trades for 180 days.

Thanks for reading. Stay safe and strong always.

With Love and Peace,

Qiongster

No comments:

Post a Comment