545 Blackburn Road, a freehold 5-storey A-grade suburban office building owned by FLCT in Victoria, Australia

The share price of Frasers Logistics & Commercial Trust (FLCT) (SGX:BUOU) took a beating today after news of an imminent war between Israel and Iran.

For the past months, FCLT share price has remained sluggish amidst softening of Australian Dollar which is the primary currency of its property income in Australia, impact from sustained high interest rate environment, economic recession fears, looming war news and so on.

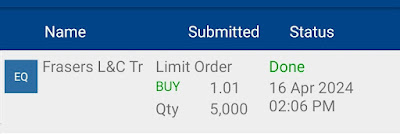

Today, my order of FLCT is filled and my investment FLCT takes a notch further.

I will now own 30,000 shares of FLCT at average net cost of $0.80

I started investing in FLCT since its IPO in 2016 when I was allocated 1,000 shares at $0.89. Since then, I slowly accumulated FLCT through dollar-cost averaging at $0.94, $0.97, $1.19, $0.97 until my last purchase in Oct 2022 at $1.13.

The investment journey of FLCT has been rewarding and fulfilling but full of volatility. I believe the impact of high interest rates and weak AUD to erode the distribution per unit of FLCT have already been priced in. As around 25% of its debts are maturing in FY24, FLCT will have to renew their loans at the prevailing higher interest rates. Although occupancy is high with positive rental reversions for the logistics properties, the commercial properties have seen declining occupancy particularly in 357 Collins Street in Melbourne, Australia and Fanborough Business Park in UK to 80% and 75% respectively.

It is possible that the share price of FLCT may remain sluggish and even test lower lows in the coming weeks but I still believe FLCT is a no brainer long-term investment to own freehold logistics and commercial properties in Australia for passive income.

I am optimistic that FLCT will enjoy a broad-based recovery in tandem with other Reits with signs of interest rate cuts and stabilisation of the AUD in time to come. Looking forward to the next dividend in May 2024 soon.

Thanks for reading.

With love & peace,

Qiongster

2 comments:

Hi bro. How did you achieve an average net cost of $0.80 when all your purchases are above $0.80 ?

After factoring in dividends collected too.

Post a Comment