The Dec 2023 tranche of Singapore Savings Bonds (SSB) has an average yield of 3.4% over 10 years.

The first 6 years yield a flat 3.3% per annum; 7th year yields 3.36% p.a, 8th year yields 3.58% p.a. and 9th, 10th years yield 3.68% p.a.

Even though such yield is lower than other low to risk-free alternatives such as T Bills and money market funds which easily yield more than 3.5% currently, it is higher than many fixed deposit rates on offer by local banks as well as CPF OA rate of 2.5% p.a.

If we also consider the great flexibility, liquidity of SSB for redemption and long-term lock down at above 3% p.a for the next decade, then this tranche of SSB is fairly enticing for us to park our spare cash at zero risk, capital guaranteed for the mid to long-term.

We could redeem SSB anytime, earning interest at 3.3% in the short-term while getting back our capital for deployment to other investments or large item purchases unlike T Bills and bank fixed deposits which would incur losses or forfeit of interest with premature withdrawals. Do note that the redemption process of SSB can be up to 1 month of lead time.

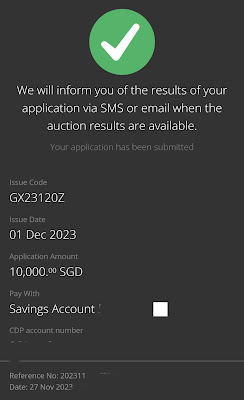

I decided to apply for $10k of this Dec 2023 tranche using my savings and war chest.

There it goes.

S$1b is up for grabs.

The first payment will be on 1 Jun 2024 and this bond will mature on 1 Dec 2033.

If you are interested in this tranche of SSB, do note that the application dateline is on today, 27 Nov 2023, 9pm for online applications.

Both short-term and long-term treasury bond yields have decreased recently and these could signal that the yields of SSB will be lower in next few months. I will still be happy to inject more cash into SSB in the next few months if the yields stay above 3%. My ultimate aim is to max out the personal limit of S$200k soon.

At the same time, I also redeemed an old tranche of SSB (SBMAY18 GX18050E) with an average yield of 2.39% and currently only yielding 2.54% in its 6th year. It is hence a no brainer decision to recycle the funds into next month's SSB.

Thank you for reading.

With love & peace,

Qiongster

No comments:

Post a Comment