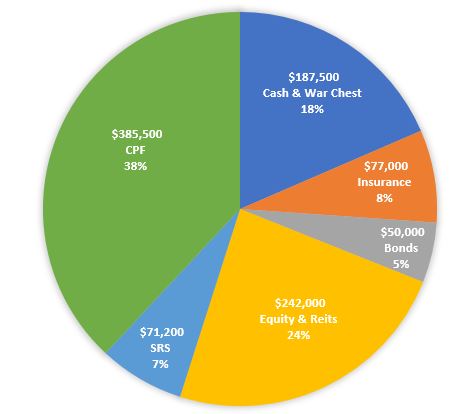

My net worth increases $21k to $1.013m, surpassing the milestone of SGD 1 million for the first time!

On 31 Dec 2019 when I kick-started this blog with a post on LIVE RICH LIFE FREE IN THE NEW DECADE, I shared about my target to achieve this milestone before age of 35. I did not expect to achieve this feat in 2020 as my net worth plummeted from $900k to a low of $850k at one point in Mar 2020.

I believe that this health pandemic is a blessing in disguise as it presented many opportunities in life during a crisis.

The opportunity to work from home helps to save time commuting to office, transport costs, food costs and avoid physical contact with colleagues or bosses whom I do not enjoy meeting. This may be offset by increased expenses in electricity bills but overall, I managed to save money and time from working from home.

Lockdown of borders between countries lead to a total curb of travel and holiday-related expenditure. I have planned short trips to Thailand, Vietnam, South Korea or Taiwan in 2020 and at least a couple of thousands have been saved from not travelling at all in 2020.

As I was fortunate to have a job supplying stable income, I injected capital consistently to buy shares from the stock market at depressed prices despite heightened fear caused by the health crisis. This helped to grow my net worth via capital gains when the share prices of many counters in my portfolio normalised to pre-Covid levels even before mankind has fully defeated the Covid virus and increased dividends from greater investment portfolio.

Early in 2020, more than $10k of interests were credited into my CPF accounts. More than $17k of passive income were collected from my bonds, dividends from stocks, Reits and interests from fixed deposits this year. All these passive income helped to boost my war chest and further fuel the growth of my net worth.

From 2021 onwards, I believe it will be the onset of a new economic cycle until another crisis kicks and history repeats itself a couple of years later. I plan to scale down the rate of growing my investments in 2021 as many company stocks and Reits are already overvalued or close to fair value. I intend to sit back, relax to enjoy the recovery ride while collecting dividends as passive income. I am sick and fed up of grinding in my current job and may look forward to finding a new gold mine to farm my bullets to build up my war chest.

Momento Mori.- "Remember that you will die"

"Love the life you live

Live the life you love."

-Bob Marley

Thanks for reading

7 comments:

no one count cpf one la...

CPF can use to pay house and medical bills leh

Wah Lao, thought what Sial. Insurance and cpf u also count inside, then I also millionaire Liao. Chey. This post like ownself post, ownself song. Boliao.

Yes I ownself post ownself song. You not happy can don't waste time read.

poor thing. have to resort to counting cpf to make ownself happy. Like that everyone also millionaire liao.

Ignore the others, the definition of networth is to include all assets and liabilities. This includes CPF, SRS, property and vehicle. We can always categorise it into short term and long term assets/liabilities to get a better picture of the networth and better plan for retirement. If one dies, all these goes to NOK.

Aiyoh, so many sour grapes. Ignore them for they do not know how useful the CPF savings can be.

Please continue to add your CPF savings into your Networth because they are still your hard earned money and they should be counted.

The CPF OA & SA savings can be used for investment. And OA savings can also be used for property purchases. They are quite liquid in a way. MA savings is less liquid but still it can be used for some insurance premiums, outpatient & inpatient treatment. And both SA & MA can be a good source for tax savings if you know how to make use of them.

Once you reached 55 yo, the OA & SA savings become free liquid cash as long as you need them (assuming you have attained the Full Retirement Sum of your cohort in your RA). If you dont need to draw on them, you can just leave the money in the OA & SA to earn compounded interest.

Here are some CPF Savings targets that my wife and I set for ourselves. You can use that or define your own CPF Savings targets

1. Become CPF Millionaires (this is the sum of all savings in all your CPF savings)

My wife and I are both CPF Millionaires. AK71 and CW8888 are also CPF Millionaires.

2. Become OA Millionaires (have a million $ in your OA savings)

My wife and I are both OA millionaires. CW8888 is also an OA millionaire, even today at 66 yo.

3. Have $2M in your CPF Savings (combined total of all accounts)

I am expecting to attain this $2M target in January of 2024. 2M62

4. 4M65 combined for a couple

My wife and I attained 3M60 and currently have $3.4M in our combined CPF savings. We are on track to achieve 4M65, barring unforeseen circumstances.

5. 1MRA combined for couple

This is to have $1M combined in our Retirement Account. We are aiming to hit this target by 67. This will mean we have to defer the CPF Life payout till after 67.

And finally the CPF Savings can provide two nice perpetual passive income streams in your retirement:

1. The interests from your OA & SA savings

For eg., the combined interests (for couple) from our OA & SA savings is expected to $68K for this year (2023)

2. CPF Life payout

We intend to defer our CPF Life payout till age 70 to give the RA more time to compound. At 70, based on our current savings in the RA, we are expecting a combined annual payout of $72,200.

The passive income from these two sources would be sufficient for our retirement. So the humble CPF should not ignored.

Post a Comment