I took some time to attend the Mapletree Industrial Trust 12th Annual General Meeting physically today at the Mapletree Business City auditorium.

Physical attendance was poor from the large number of empty seats as the AGM could also be watched through live webcast online.

Let me summarise the 5 things I learnt from this meeting.

1. Strong income producing ability

Distributable income in FY21/22 is $350.9m increased by 18.8% year-on-year. DPU of 13.8 cents. This is great for investors.

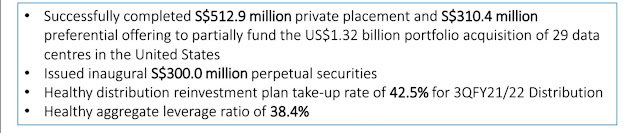

2. Great financial flexibility

3. Strong financial results

4. Strong Balance Sheet

5. Hedged from interest rate impact

The management plans to maintain hedged loans at between 70% and 80% instead of 100% in order to preserve some financial flexibility and the hedges come at a cost i.e. 3% interest cost effectively immediately with an impact on DPU.

6. Portfolio Highlights

No comments:

Post a Comment