As year 2021 is nearing an end, let me reflect, highlight and share on the 11 things I experienced the very first time for the past 12 months.

1. Changed Job

First and foremost, I changed job for the very first time in my life, in line with the Great Resignation trend globally. This decision came after much deliberate thought, analysis and when an opportunity comes at the right time, I simply grabbed it and moved on. I have shared on the 10 reasons why I was quitting job. Our job yields the greatest dividends from us trading our time to produce work for our employer. Our remuneration usually is a measure of the perceived intrinsic value of our investment in own education, knowledge and gaining of past experiences.

2. Stayed in Singapore Hotels

With SingapoRediscover vouchers given by the government to support local tourism business, I happily redeemed the vouchers for staycations in Singapore hotels. Prior to the pandemic, I have never stayed in local hotels before. Refer to previous blogs on my staycations in Yotel Air Changi Airport Jewel and Hotel G.

3. Cryptocurrencies

As the price of bitcoin peaks at record high of US$69k in Nov 2021, the FOMO feeling in me was ignited. A decade ago, I thought that cryptocurrencies were worthless as dirt, not supported by underlying authorities, businesses and assets, and were merely gambling instruments. However, in recent years, my opinion of cryptocurrencies completely changed. When bitcoin has emerged as the primary dominant "digital gold" asset in recent years, I have been procrastinating and wondering when would be the best time to get onto this wave. After Facebook changed its name to Meta, I decided to open crypto exchanges accounts to kickstart my crypto journey. The realization of the upcoming Metaverse awakened my instinct in the need to own digital currencies now and for the future. The best time to invest in crypto was a decade ago and the next best time is now.

For those of you interested to sign up for Crypto.com exchange platform, you may use my referral link

here. We both can get USD25 worth of CRO tokens when you stake $500 of CRO tokens for a Ruby card or above.

4. US/HK Stocks

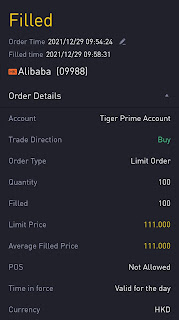

I opened low-cost brokerages - Moomoo and Tiger Broker and funded them to enjoy free Apple shares. Like cryptocurrencies, I have been wanting to get on the journey of owning the world's most popular tech and consumer businesses such as Apple, Microsoft, Amazon, McDonald's, Nike, Walt Disney, Alibaba and so on. Having traded and invested in SGX stocks for more than a decade, it is evident that the local stock market lack enough growth businesses as only banks and Reits are worth investing. The old school blue chips in SGX have faltered, stagnated and failed to grow at decent pace anymore.

Thanks to the low-cost brokerages, I managed to create new portfolios containing US and HK growth stocks. I plan to accumulate more growth stocks slowly through dollar-cost averaging over the next few years, en route to financial freedom journey.

Get your free Apple share from Moomoo using my referral link.

Get your free Apple share from Tiger Broker using my referral link.

5. Bought HDB

I made the down-payment of a 3 room HDB BTO in Jun 2021 together with Ms Doraemon. The property is located in District 13 city fringe beside an MRT station and will be ready in 5 years time. This is another life decision. The plan is to use the waiting time to build up savings in CPF OA account and then fully pay off the HDB flat when collecting keys. To be able to sleep peacefully every night with no liabilities nor debts is a divine gift. To be able to own a roof over our heads without cash outlay is a feat only easily achievable on this Singapore island.

6. WFH for most number of days a year

Out of 261 work days in 2021, I worked in office not exceeding 50 days. This means I work from home more than 80% of this year, which is a record ever since my working life. Prior to the pandemic, I seldom work from home as I prefer not to work in the place where I enjoy quality sleep and 'me' time. This pandemic has provided an opportunity to mix work and rest together, giving pros and cons. As I saved more time commuting and money on lunches, I put on weight and felt the extra inches while wearing those old pants.

7. Met the least people

As virtual meetings on Webex, Skype, Zoom and Google Meet have become the norm, I met the least number of real physical people this year compared to all other years in my life. Besides meetings during work, even AGMs, courses, webinars are conducted virtually online, allowing us to siam all the physical real people, which can be a good thing for introvert like me.

8. Cashed out from this blog website

On 23 Sep 2021, I cashed out dividends from this Live Rich Life Free blog. Google Adsense paid me $156 for the ads rendered or clicked on this website since Jan 2020. I did not expect such monetary incentive when I started this blog close to 2 years ago. Nonetheless, such incentive would motivate me further to create more financial content for sharing to the investment community and world.

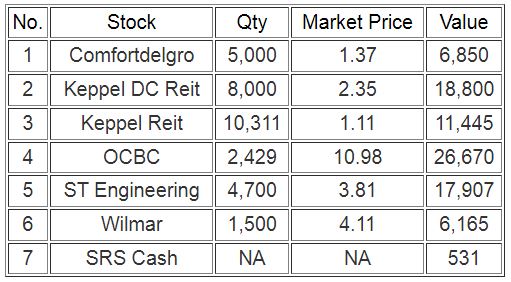

9. Passive income exceed $15k

For the first consecutive year, I received passive income from dividends and interests amounting to more than S$15k. Prior to 2020, my investment portfolio was too small to yield decent amount of dividends. Before 2015, I was merely trading stocks to reap short-term gains and did not adopt a long-term stance for investments. I am happy with the investment journey so far and will continue to build up the SGX income portfolio for more dividends in future years to come.

10. Investment in Self

With more time at home, I invested aggressively in myself to learn, gain knowledge and broaden horizons through attending many courses, webinars and workshops. I then obtained the most number (>5) of professional certifications and accreditations ever in my life this year. Getting certified by Microsoft and Google do boost my credentials and recognise my expertise and skills in the computing world, thereby helping in my career progression in the future hopefully.

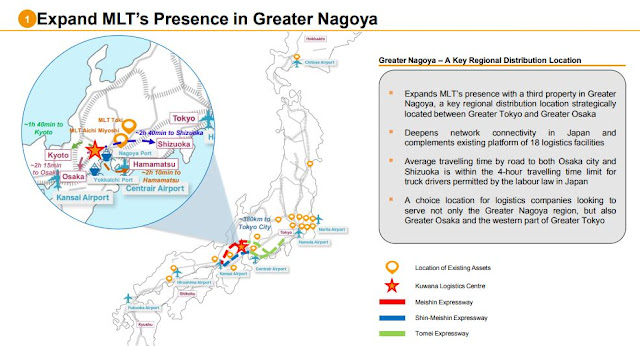

11. Millionaire for the entire year

Last but not least, my net worth stayed above SGD 1 million throughout the year and increased by around $150k from Jan 2021. I did not invest aggressively this year as my strategy was to grind at work, earn the monthly pay cheque, save up, sit back and let the equities recover in tandem with the economy, while collecting dividends. My main track is to slowly increase investments. On side tracks, I explored into cryptocurrencies and started new mini growth portfolios in the US stock market.

Conclusion

Despite the ongoing pandemic, 2021 has been a breakthrough and revolutionary year for me. I look forward to the coming year 2022 and hope it will bring greater opportunities and dreams.

Have you reflected on your achievements for this current year?

Thanks for reading. Stay safe and strong always!

With love & peace,

Qiongster