It is the last day of November 2021 and it is time to review my investment portfolios.

Generally the global stock markets started correction in recent days due to fears and uncertainty about the new Omicron virus strain. Whatever goes up will come down and the stock market will not rise in a straight line. It is pretty normal that every now and then, there will be "noises" that cause the stock markets to "crash". Will this time be another crisis or opportunity?

Portfolio Actions

1. Sold 18,000 shares of Sembcorp Marine to Temasek at price of $0.08.

2. Bought 1,500 shares of Wilmar at price of $4.33 in SRS account.

3. Sold 2 units of Palantir, PLTR211210 put option with $22 strike price at US$0.62.

Portfolio Dividends

1. Received $114 from Savings Bonds on 1 Nov.

2. Received $139.16 of dividends from Capitaland China Trust on 8 Nov.

3. Received $43.60 of dividends from Ascott Reit on 9 Nov.

4. Received $270 of dividends from Guocoland on 25 Nov.

5. Received $182.67 of dividends from Frasers Centrepoint Trust on 29 Nov.

6. Received $111.60 of dividends from Suntec Reit on 29 Nov.

7. Received $482.90 of dividends from Mapletree Commercial Trust on 30 Nov.

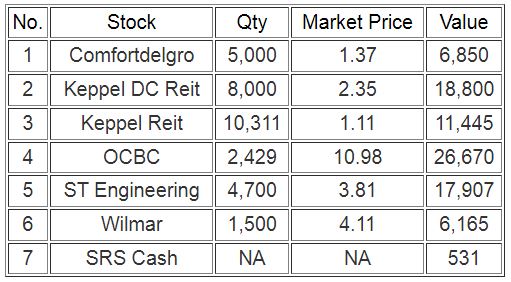

SGX Income Portfolio

US Growth Portfolio

No comments:

Post a Comment