After the previous preferential offering by Mapletree Logistics Trust (SGX:M44U) in Nov 2020, it is time for another round of equity fund raising.

Actually, I have been quietly anticipating for any of the Mapletree Reits to announce acquisitions and equity fund raising throughout the months and it has finally arrived. I like preferential offerings because it is a seamless and fuss-free way to add shares to increase investments in high quality income-producing Reit without incurring commissions and trading fees. Usually when such acquisition news are released, the price of the Reit will take a beating and undergo some weakness for a period of time, presenting opportunity to also add shares from the market.

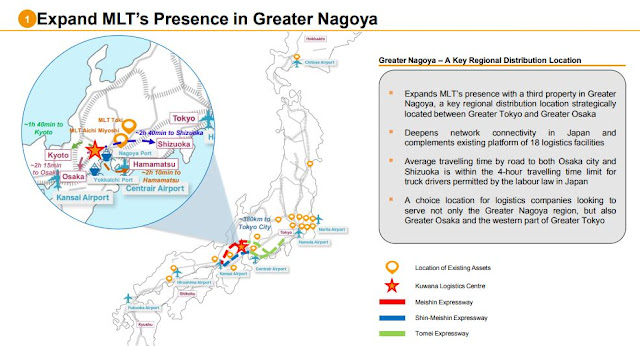

On 23 Nov 2021 today, MLT has announced a proposed acquisition of 17 grade-A logistics properties in China (13), Vietnam (3) and Japan (1) for $1.4 billion. The 13 China properties will be acquired for 1.15 billion yuan (S$243.6 million) in cash, while the remaining amount will be inter-company loans worth 1.77 billion yuan that MLT will pay through cash and new units, as well as 1.24 billion in bank loans. The Vietnam properties will be paid US$14.4 million in cash with the rest via inter-company loans. The Japanese property will be paid fully in cash at 1.7% discount to the independent valuation.

An equity fund raising will raise around $700 million. The fund raising comprises of a private placement of between 209.3 million and 215.1 million new units at an issue price of between S$1.86 and S$1.91 per new unit to raise around S$400 million. A non-renounceable preferential offering of up to 163.4 million new units to existing unit holders at between S$1.82 and S$1.87 per new unit will raise about S$300 million.

What is my take?

As of time of writing, details on the preferential offering for existing unitholders are not released yet.

There is an advanced payment of between S$0.0145 and $0.0147 on 12 Jan 2023 in lieu of the enlarged unitholdings after the private placement exercise, which will be a test bed for the institutional investors on the popularity of this equity fund raising to determine the exact unit price for the non-renounceable preferential offering.

I will participate in this equity fund raising of preferential offering as I believe in the riding on the waves of booming e-commerce underpinned by Asian thriving logistics hubs of China and Vietnam for the long-term. Mapletree Logistics Trust has a great track record of rewarding unit holders with consistent, increasing income through aggressive expansion of its footprint in the Asian logistics markets. This time will be no different.

No comments:

Post a Comment