My SGX Income Portfolio value increases $16k to $279k compared to $263k in end Jun 2021. I injected a $6k capital to initiate a position in Capitaland China Trust.

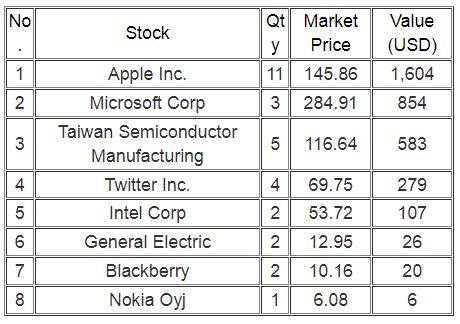

My US Growth Portfolio value inches up to US$3.4k from US$3k. I managed to get free shares of General Electric, Nokia and Blackberry from participating events in the Moomoo trading platform.

For my SRS portfolio, its value increases slightly to $95.4k, contributed largely by the increase in share price of Keppel DC Reit which reported a 12.5% 1H DPU growth and made its maiden investment in China data centers, and OCBC which has its dividend cap lifted by MAS.

A new round of quarterly and half yearly reporting for the Reits and companies has begun and I look forward to receiving streams of dividends amounting more than $3k as passive income to boost my war chest. I aim to continue building up my US growth portfolio, while monitoring for opportunities to add shares in my SGX income portfolio.

The situation of Covid pandemic has worsened in Singapore recently. Do remember that every crisis creates opportunities and I hope for the share price of retails Reits such as Frasers Centrepoint Trust and Capitaland Integrated Commercial Trust to weaken for us to add shares. Of course, I do hope that the situation will be brought under control, in tandem with the increase in vaccination rate, then this health pandemic will be just an endemic and we could then carry on with our lives in normality.

Portfolio Actions

1. Nibbled 2 shares of Intel at US$54.18

2. Received 2 shares of General Electric, 1 share of Nokia and 1 share of Blackberry for free

3. Received 2 shares of Twitter Inc from referrals

3. HUYA210716 put option with $14 strike price has expired

4. Bought 5,000 shares of Capitaland China Trust at $1.35

Portfolio Dividends

1. Received 151 shares of Far East Orchard @$1.085 for $163.95 of dividends on 5 Jul

SGX Income Portfolio

S$279k

US Growth Portfolio

US$3.4k

SRS Ultra Long-Term Portfolio

Thank you for reading. Stay safe and be strong as always.

With love & peace,

Qiongster

No comments:

Post a Comment