The love-hate relationship between me and Sembcorp Industries (SGX:U96) officially ends today.

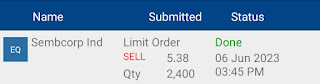

I sold off my paltry 2,400 shares of Sembcorp Industries at $5.38.

In 2015, after switching from a trader to become a novice investor, the first stock on SGX I picked and nibbled was Sembcorp Industries (SCI).

My purchases were 800 shares at $4.18 on 24 Feb 2015, 700 shares at $4.77 on 22 Apr 2015 and 900 shares at $3.15 on 2 Dec 2015. The average holding cost was around $4.00. I made full use of the $10 odd lot (<1000 shares) brokerage promotion after I opened my POEMS account with Philips Securities.

That decision was made after attending many seminars, read many books on value investing, fundamental analysis and so on.

At that time, I believed in the long term prospects of SCI as a global leading energy provision, utilities supply, waste management and urban solutions conglomerate. I thought the regional demands for the services provided by SCI will remain strong and grow perpetually, without taking into consideration that such business is actually cyclical in nature and pose great challenges with high risks.

All my savings for half a year were channeled into SCI due to my strong belief.

It was heartbreaking and disappointing to see the share price of SCI plummet through various levels of supports, reaching lower lows and breaking records every year. It even hit $1.18 during the pandemic in 2020.

I did not bother to average down nor add on to the investment of SCI for the past 8 years, which I collected more than $2.7k worth of dividends including the "free" Sembcorp Marine shares.

However, I also did not cut my losses nor rebalance my portfolio by swapping SCI for other high quality Reit. I executed such portfolio rebalancing moves for my disappointment SingTel, Starhub and SATS.

After factoring in the dividends collected, my net cost for SCI is $2.67. Selling at $5.38 gives a return of slightly more than 100% over 8 years. This is the reward for conviction and loyalty in a great cyclical business.

The fundamentals and main business of SCI have not really changed over the years. Just that it's value was unlocked and the shift in focus towards green renewable energy, together with recent positive catalyst news from capital recycling actions such as divestment of Indian energy division and waste management business SembWaste, propelled the share price of SCI like a rocket for the past year.

I believe it is time for me to recycle my capital and locked in the profits from SCI as nothing goes up forever in this world due to gravity. The funds will go into my warchest for potential reinvestment into local banks or high quality Reits in the coming weeks.

No comments:

Post a Comment