What a finale to an epic 2020!

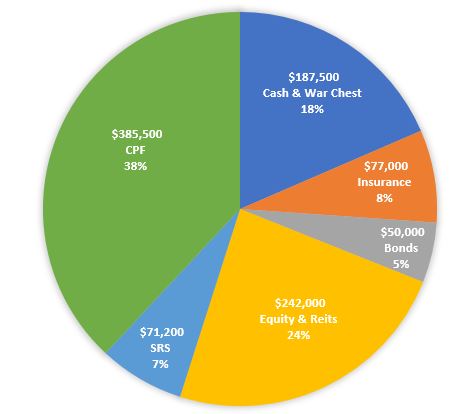

My portfolio value increases $20k to surpass $240k after capital injections of around $13k and buoyed by strong recovery of retail Reits in Dec 2020. I am glad and satisfied to be given the opportunities to continue building and strengthen my portfolio in 2020. Not only has the portfolio value grows, I managed to initiate new positions in quality Reits and bank such as Mapletree Industrial Trust, Mapletree Logistics Trust, Frasers Centrepoint Trust and UOB in 2020. This portfolio provides a strong foundation for me to continue building up my passive income in pursuit of financial freedom.

Portfolio Actions

1. Gotten 2,000 shares of Ascendas Reit at preferential offering price of $2.96

2. Added 600 shares of Mapletree Logistics Trust at $1.92

3. Added 2,000 shares of Mapletree Industrial Trust at $2.83

Portfolio Dividends

1. Received $109.50 from a $10k Singapore Savings Bond on 1 Dec

2. Received $92.10 of dividends from Mapletree Industrial Trust on 1 Dec

3. Received $67.57 of dividends from Frasers Centrepoint Trust on 4 Dec

4. Received $53.56 of dividends from Mapletree Logistics Trust on 4 Dec

5. Received $126.50 of dividends from Netlink Trust on 4 Dec

6. Received $459.20 of dividends from Ascendas Reit on 11 Dec

7. Received $610.20 of dividends from Frasers Logistics & Commercial Trust on 17 Dec

8. Received $640.00 of dividends from Aims Apac Reit on 18 Dec

9. Received $100.67 of dividends from Mapletree Nac Trust into SRS on 28 Dec

Portfolio Value $243KMy ultra long-term SRS portfolio value increases $7k to $81k. Comfortdelgro and Keppel Reit are on their way to recovery while the rest are fairly stable and in consolidation phase. All counters in this portfolio are likely to do well in the long future but if the Covid situation triggers another round of lockdown and economic stagnancy, then things will get worse before the overall situation improves.

Portfolio Value $81KMy war chest stands at a meagre $1.8k which means that I will not have sufficient ammunition to invest more in the near future. First quarter results reporting are looming and I am expecting some dividends to boost my war chest in Feb 2021.

My investment strategy for 2021 will be to adopt a more passive and laid-back approach. Firstly, to conserve and pump monies into CPF Special Account and SRS in 1Q 2021, then build up war chest and capitalise on any retracement or correction opportunities from 2Q to 4Q 2021, while collecting dividends, adding slowly to investments instead of gobbling because the stock market is no longer as undervalued as in 2020.

At the same time personally, it is important to invest in my own skillsets by picking up technical skills such as cloud computing, programming and enriching my mind and soul with knowledge from books and Youtube videos.

On this last day of 2020, it is time to put the darkest days of 2020 behind us, focus on the present and embrace the future! 2021 will be a better year for investors and mankind!

Thanks for reading. Stay Strong and Happy New Year to all!