I checked my CPF accounts today and noticed that some money is missing in Medisave.

It is no longer at the cap amount of $63k.

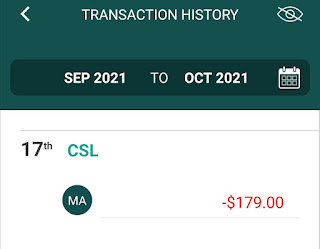

$179 to be exact.A quick check on recent transactions reveal this deduction labelled as CSL, which means Careshield Life premium deduction.

Careshield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled and need long-term care.

This scheme was announced on Aug 2020 and is compulsory for Singapore citizens born in 1980 or later, but us optional for Singapore citizens born in 1979 or earlier.

This scheme provides lifetime coverage once you completed paying all your premiums, which will happen in the year you turn 67, or 10 years after you join the scheme, whichever is later.

The benefits are monthly lifetime cash payouts for as long as you remain disabled. Payouts start at $600/month in 2020 and $612/month in 2021 and will increase over the years, in tandem with premium increments.

Even though the intentions of this scheme are good, personally, I do not like this scheme as I do not like the idea of having my money being deducted from my savings account without my consent and not receiving any notice in advance. I also do not like being deprived of insurance choices. This is a forced move similar to Medishield life.

If you are auto enrolled or intend to entrol in this scheme, check out the premiums here.

Thanks for reading. As always, stay safe and remain strong.

With love & peace,

Qiongster

7 comments:

Stupid Niao Kia. Post that u are a millionaire but a deduction of 179 and u come to cyberspace to Kpkb. Maybe when u get disabled u will start to appreciate this.

I cancelled thw eldercare a few years ago. I have other insurance plans and don't find this enough to cover me.

My friend told me the payout versus premium not attractive. You can calculate and see if true.

Yes quite true. For $200 odd dollars just to have around $7k of allowance is too low compared to other term insurance.

Yes I am niao kia indeed. I am talking to myself why I do not like this scheme. It is subjective whether one like such mandatory insurance or not. I do not require such insurance as my monthly passive income already exceeds the payout of this scheme. I hope you will appreciate the payout of such insurance more when you become disabled.

I am the first commentator, I apologise for my rough tone. Not cursing you to get disabled. Sorry …

No worries. We are just sharing our opinions on air. To each his own. Cheers!

Post a Comment