August 2021 has come to an end and it is time to review my investment portfolios. More than $20k is shed but I have no feel!

My SGX Income Portfolio value plummets $15k to $264k compared to $279k in end Jul 2021. I hope this is just a healthy 5% correction.

My US Growth Portfolio value inches up to US$3.5k from US$3.4k. I am too late into the game but will build up slowly when opportunity arises.

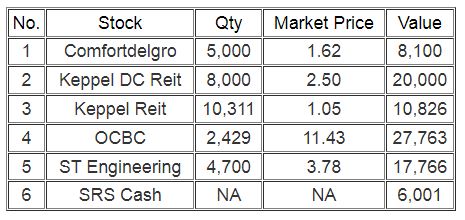

My SRS Ultra Long-Term Portfolio value decreases $5k to $90.4k. In line with the SGX portfolio, it seems like a healthy 5% correction.

Portfolio Actions

1. Sold 1 unit of MPW2100917 put option with $19 strike price at US$0.23.

2. 2 units of General Electric refunded at US$25.05 due to reverse split 1 for 8.

3. Sold 11,800 shares of Sembcorp Marine at $0.092.

Portfolio Dividends

1. Received $235.80 of dividends from Frasers L&C Trust on 24 Aug.

2. Received $48 of dividends from Sembcorp Industries on 24 Aug.

3. Received $607.25 of dividends from OCBC in SRS on 26 Aug.

4. Received $163.60 of dividends from Ascott Reit on 27 Aug.

5. Received $207.02 of dividends from Keppel Reit in SRS on 27 Aug.

6. Received $105.45 of dividends from Suntec Reit on 27 Aug.

7. Received $235 of dividends from ST Engineering on 31 Aug.

SGX Income Portfolio

US Growth Portfolio

SRS Ultra Long-Term Portfolio

Thank you for reading. Stay safe and be strong as always.

With love & peace,

Qiongster

No comments:

Post a Comment