Happy Labour Day on 1 May 2025. Time for an update of my investment portfolios.

My SGX Income Portfolio value decreases to $382k from $388k. S-Reits have remained sluggish after recent recoveries due to institutional inflows and the market sentiments do still believe that interest rates have peaked and will be cut at least 2 times in 2025. Immense fears from global trade war and potential recession have subsided but future uncertainties are still causing the US and Asian stock markets to stay volatile.

My US Growth Portfolio tanks to US$8.7k from US$10k due to my exposure to cash secured NVIDIA and GOOGL put options which have resulted in hefty paper losses. Nonetheless, I still believe in their long term growth potential and plan to keep rolling over the options to delay the expiry date or take assignment of the NVIDIA and GOOGL shares.

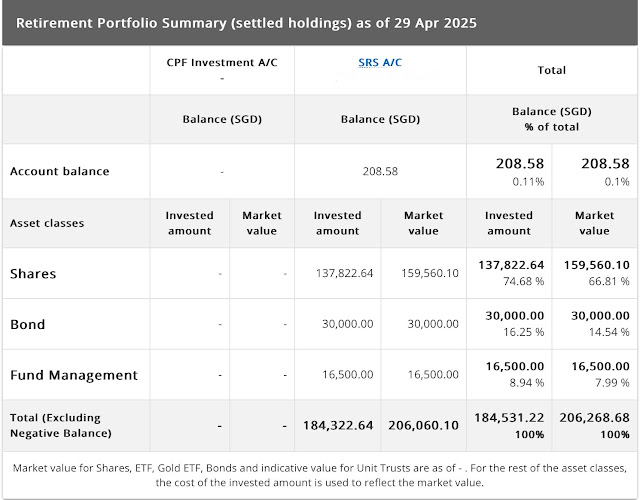

My SRS Ultra Long-Term Portfolio value falls to $206k from $212k mainly due to correction of OCBC share price.

Portfolio Actions

1. Bought 300 shares of DBS at $38.08 in SRS.

2. Subscribed 4,000 shares of Frasers Centrepoint Trust at $2.05.

3. Rollover 1 put option of Nvidia with strike price $116 with expiry date 19 Dec.

4. Rollup 1 put option of GOOGL with strike price $200 with expiry date Dec 26.

Portfolio Dividends

1. Received $303 of dividends from SSB on 1 Apr.

2. Received $147.50 of dividends from SSB in SRS on 1 Apr.

3. Received $600.60 of dividends from DBS on 16 Apr.

4. Received $300 of dividends from DBS in SRS on 16 Mar.

SGX Income Portfolio

Portfolio Value = $382k

Disclaimer: This article is for informational purposes only and does not constitute financial advice. It's crucial to conduct your own research or consult with a qualified financial advisor before making any investment decisions.

No comments:

Post a Comment