Sunday, June 30, 2024

Passive Income in 2Q and 1H 2024 Exceeds $15k!

Saturday, June 29, 2024

Portfolio Update June 2024

This is a quick update of my investment portfolios for June 2024 before I fly off for a China trip funded by dividends.

My SGX Income Portfolio value decreases to $359k from $365k.

My US/HK Growth Portfolio value inches up to US$18.6k from US$18.5k.

My SRS Ultra Long-Term Portfolio value stagnates at $168k.

The US stock markets have challenged new highs amidst uncertainties over interest rates, ongoing wars and fears of economic recession. US 10-year and 30-year government yields have declined and the Federal Reserve is expected to hold interest rates high with a possibility of no rate cut for the year.

Despite being clouded by uncertainties, immense noises and fears, it is crucial that long-term investors like us always remain calm, unwavered and focused on our investment objectives. Stick to our own plan and continue deploying our financial resources into high quality income-producing instruments such as government-backed risk-free bonds, property assets, or strong growth businesses tactfully according to our own risk appetite.

Besides subscribing to Singapore Savings Bonds and rolling over Alphabet call option, I did not make any other moves in the stock markets. I also collected some dividends towards the end of 2024 mid-year.

Portfolio Actions

Portfolio Dividends

1. Received $530.91 of dividends from Savings Bonds on 1 Jun.

2. Received $188 of dividends from ST Eng on 5 Jun.

3. Received $458 of dividends from MPACT on 6 Jun.

4. Received $504.84 of dividends from Mapletree Ind Trust on 10 Jun.

5. Received $132.50 of dividends from Netlink Trust on 12 Jun.

6. Received $1,044 of dividends from Frasers L&C Trust on 18 Jun.

7. Received $829.50 of dividends from Aims Apac Reit on 24 Jun.

8. Received $461.32 of scrip dividends from Mapletree Log Trust as 347 shares on 26 Jun.

SGX Income Portfolio

Portfolio Value = $359k

Moomoo

Tiger Broker

Syfe Trade

US$1.1k

SRS Ultra Long-Term Portfolio

Tuesday, June 25, 2024

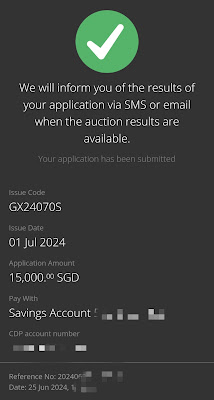

Applied for Singapore Savings Bonds (SBJUL24 GX24070S) Redeemed SSB (SBDEC18 GX18120X)

The July 2024 tranche of Singapore Savings Bonds (SSB) has an average yield of 3.3% over 10 years.

The first 6 years yield a flat 3.26% per annum; 7th year yields 3.29%, 8th year yields 3.38% p.a and 9th, 10th years yield 3.42% p.a.

Saturday, June 15, 2024

Why I Paid Off my Income Tax One-time in Full?

Net Worth Update June 2024

I am happy to share my net worth for June 2024! It has reached S$1.643 million, another record high thanks to contributions to my CPF, salary savings and some dividend collections.

Asset Breakdown:

Safe Heavens (62%)

CPF (37%): Huge shoutout to my CPF for making a significant portion of my wealth. Attaining Full Retirement Sum FRS in 2022 was a great accomplishment.

Cash and war chest (15%): My cash is strategically placed in fixed deposits and Fullerton cash funds earning over 3% p.a.

Bonds (10%): A mix Singapore Savings Bonds and Astrea bond provides stability. I am planning to add to this with the upcoming Jul 24 SSB with average yield of 3.3%.

Retirement Savings (8%)

SRS: I have already maxed out the $15.3k contribution limit for 2024, adding another layer to my retirement savings plan.

Income and Growth Assets (32%)

Stocks and Reits (24%): This portion of my portfolio caters for generation of passive cashflows and potential growth, with a focus on long-term compounding growth through dividend investing.

Tracking net worth is not just about the final figure. It is about seeing the results of all those past financial decisions. This update is a reminder that every step forward, big or small, is worth celebrating. This keeps me motivated on the journey towards financial freedom.

Thank you for reading!

Saturday, June 01, 2024

Portfolio Update May 2024

Here is an update of my investment portfolios for May 2024.

My SGX Income Portfolio value dips slightly to $365k from $366k.

My US/HK Growth Portfolio value inches up to US$18.5k from US$17.9k.

My SRS Ultra Long-Term Portfolio value increases to $168k from $163k mainly due to dividends collected.

The US stock markets have challenged to sustain its highs amidst uncertainties over interest rates, ongoing wars and fears of economic recession. US 10-year and 30-year government yields have rebounded and the Federal Reserve is expected to hold interest rates high with a possibility of no rate cut for the year.

Despite being clouded by uncertainties, immense noises and fears, it is crucial that long-term investors like us always remain calm, unwavered and focused on our investment objectives. Stick to our own plan and continue deploying our financial resources into high quality income-producing instruments such as government-backed risk-free bonds, property assets, or strong growth businesses tactfully according to our own risk appetite.

Portfolio Actions

Portfolio Dividends

1. Received $463.50 of dividends from Savings Bonds on 2 May.

2. Received $850 of dividends from UOB on 9 May.

3. Received $188 of dividends from ST Engineering on 14 May.

4. Received $165 of dividends from Wilmar on 14 May in SRS.

5. Received $540.54 of dividends from DBS on 20 May.

6. Received $2,100 of dividends from OCBC on 20 May in SRS.

7. Received $126 of dividends from OUE on 24 May.

8. Received $185.12 of dividends from Astrea 7 A-1 PE Bond on 27 May.

9. Received $212.64 of dividends from Frasers Centrepoint Trust on 30 May.

10. Received $75.55. of dividends from Suntec Reit on 30 May.

SGX Income Portfolio

Portfolio Value = $365k

Moomoo

Tiger Broker

Syfe Trade

US$1k

SRS Ultra Long-Term Portfolio

Portfolio Value = S$168k