Happy Diwali! On the last day of October 2024, time to review my investment portfolios.

With the world grappling with geopolitical tensions, economic uncertainties and as the US presidential election looms, my investment portfolios have experienced some retracement. This serves as a reminder of the risks and volatility associated with investing and the importance of adopting a long-term perspective.

My SGX Income Portfolio value has declined to $386k from $399k because local S-Reits experienced harsh reality checks from their recent results announcement, reflecting the impact from from the past years of high interest rates resulting in higher borrowing costs and erosion of net property income and dividend payouts.

My US/HK Growth Portfolio has also seen a positive performance, rising to US$19k from US$18.8k.

My SRS Ultra Long-Term Portfolio value has stagnated at $183k.

Market Outlook

The US stock market has continued its upward trajectory in a healthy bull run on the back of looming presidential election and higher certainty of a lower interest rate environment in the coming future. Nonetheless, there will still be immense volatility from the occasional noises and fears attributable to ongoing geopolitical conflicts, and concerns about a potential economic recession. Despite these challenges, I believe that long-term investors should remain calm and focused on our investment objectives.

Investment Strategy

My investment strategy remains unchanged. I continue to prioritize high-quality income-producing instruments, such as government-backed risk-free bonds, property related assets, and strong profitable growth businesses. I am on the sidelines camping for local banks and US growth tech stocks. By carefully diversifying my portfolio and remaining disciplined, I aim to weather any market storms and achieve my long-term financial goals.

Portfolio Actions

Portfolio Dividends

1. Received $147.50 of dividends from Savings Bonds in SRS on 1 Oct.

2. Received $303.00 of dividends from Savings Bonds on 1 Oct.

3. Received $399.72 of dividends from Capitaland Integrated Commercial Trust on 17 Oct.

SGX Income Portfolio

Portfolio Value = $386k

Moomoo

Tiger Broker

Syfe Trade

US$1.1k

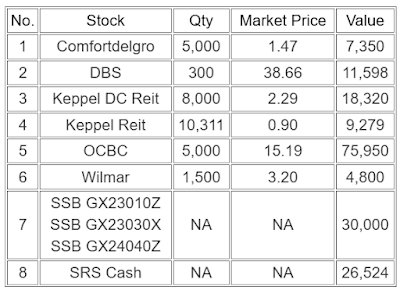

SRS Ultra Long-Term Portfolio

No comments:

Post a Comment