The April 2023 tranche of Singapore Savings Bonds (SSB) has an average yield of 3.15% over 10 years.

This is not very appealing considering that other low to risk-free alternatives such as T Bills and bank fixed deposits easily yield more than 3.5% currently.

However, if we consider the great flexibility, liquidity of SSB for redemption and long-term lock down at above CPF OA yield for the next decade, then this tranche of SSB is fairly decent for us to park our spare cash at zero risk.

Furthermore, both short-term and long-term treasury bond yields have declined recently and the interest rate hikes have sort of peaked with the markets factoring in interest rate cuts next year. These could signal that the yields of SSB declining in next few months.

We could redeem SSB anytime in the coming months, earning interest at 3.01% while getting back our capital for deployment to other investments or large item purchases unlike T Bills and bank fixed deposits which would incur losses or forfeit of interest with premature withdrawals.

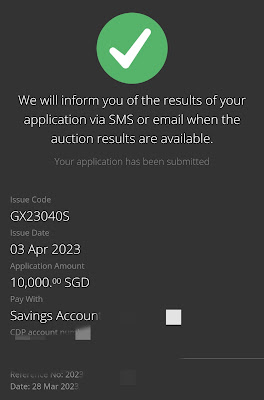

I decided to apply for $10k of this Apr 2023 tranche using my idle war chest funds which were initially earmarked for adding local Reits.

There it goes.

$700m is up for grabs. Due to the relatively low yield, I anticipate moderate popularity for this tranche and almost guaranteed allotment of at least $20k per person.

The first payment will be on 1 Oct 2023 and this bond will mature on 1 Apr 2033.

If you are interested in this tranche of SSB, do note that the application dateline is on today, 28 Mar 2023, 9pm.

Thanks for reading.

With love & peace,

Qiongster

No comments:

Post a Comment