Happy Lunar New Year!

I still have idle funds lying in SRS account earning meagre 0.05% after the partial allocation in previous T-Bill application.

Great opportunity costs incurred from waiting on the sidelines to add investment for local banks such as OCBC or UOB shares into my SRS portfolio.

The share prices of local banks have no sign of weakening in the short-term hence I decided to deploy the idle SRS funds into this latest tranche of Treasury Bill.

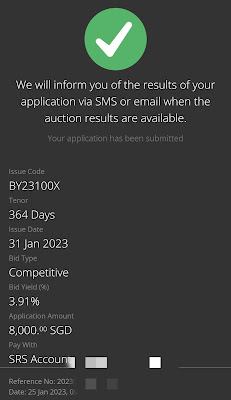

The auction date for latest tranche of T-Bill is on 26 Jan 2023 and I decided to try my luck to auction for this tranche of T-Bill, a short-term government debt security with 12 months tenor, fully backed by the Singapore government and having an AAA credit rating.

The issue date is on 31 Jan 2023 and maturity date is on 30 Jan 2024. Results will be out on 26 Jan 2023, 1pm.

There it goes.

There is no admin fee for internet banking applications unlike SSB.

I look forward to a successful application and hope to lock in my SRS funds for 12 months at above 4% yield before getting it back to apply for SSB early next year.

Thanks for reading. Stay focused and remain steadfast as always!

With love & peace,

Qiongster

No comments:

Post a Comment