Today is the last day of October 2022 for me to give an update on my investment portfolios.

My SGX Income Portfolio value increases to $272.6k from $266.2k last month as my injected capital of around $19k to add FLCT and FCT was offset by the crash of REITs from factoring in the impact of further interest rate hikes to potentially 4.5% by end of this year. The share price of REITs need to be compressed to maintain the same risk premium from the higher risk free rate. It is a short-term pain to swallow huge paper losses which at one point amounted to more than $30k.

1. Bought 7,000 shares of Frasers Logistics & Commercial Trust at $1.13.

2. Sold 3 units of Palantir, PLTR221014 call options with $8 strike price at US$0.09.

3. Sold 3 units of Palantir PLTR 221021 call options with $8 strike price at US$0.15.

4. Sold 300 units of Palantir as the call options were exercised at $8.

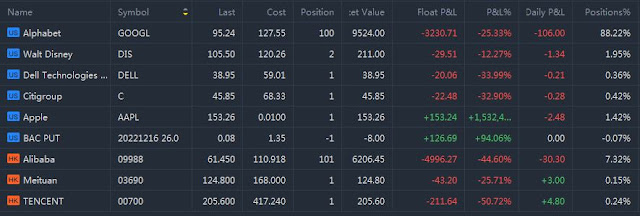

5. Sold 1 unit of Alphabet, GOOGL221028 call option with $108 strike price at US$1.28.

Portfolio Dividends

1. Received $102.50 of dividends from Savings Bonds on 1 Oct.

2. Received $86.24 of dividends from Ascott Reit on 18 Oct.

SGX Income Portfolio

No comments:

Post a Comment