After the announcement on the recapitalisation of Sembcorp Marine and demerger of Sembcorp Marine from Sembcorp Industries in Jun 2020, I have shared my opinion on the possible action plans for this demerger.

What will I do about Sembcorp Industries?

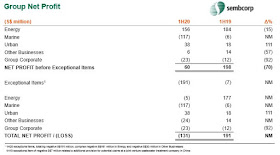

Sembcorp Industries has announced their poor but expected 1H 2020 results on 17 June 2020 and reported a $131m loss, compared to $191m profit in 1H 2019.

The urban segment is able to make profits of $38m. The energy, corporate and marine divisions all chalked up losses, with marine contributing up to $117m of losses.

It is important to note that the loss on paper is largely attributed to the one-off exceptional items of $191m. Writing off of asset values and impairment of investments are accounting treatments and do not result in actual cashflows.

The energy business actually has a net profit of $156m before a write off of $161m to become accounted with a net loss of $5m.

Source: Sembcorp Industries Presentation Slides for 1H 2020 Results

The energy business is still largely profitable from operations despite general drop of oil and gas prices in recent months. However, the profit from operations is dragged down by business operations in Singapore and India. In Singapore, the 47% drop in operational profit is due weaker demand caused by Covid-19 and lower price of high sulphur fuel oil (HSFO). In India, the $29m drop in operational profit is caused by lower electricity demand and lower prices by Thermal Power Project 2.

It is disappointing that there is no interim dividend declared for 1H 2020 as the company board has prudently decided to defer the dividend consideration to the full year.

Despite gauging $2 to be a fair value and having plenty of opportunities to sell it above $2, I am keeping my little shares in Sembcorp Industries after considering having to suffer a massive loss from an average holding cost of $3.30 and having kept them for more than 5 years already. I decided to give Sembcorp Industries a fighting chance for another 5 years to propel its energy utilities business if they can get rid of the disastrous marine sector.

Sembcorp Industries will be able to start off with a clean slate in Sep 2020 if the EGMs approve the recapitalisation and demerger plans by end Aug.

It is important to note that the ex-dividend price of Sembcorp Industries can drop to possibly as low as $1 and we should be conservative to not assume the share price of the "free" Sembcorp Marine shares will trade above $0.20. There is no free lunch. Institutional funds have pumped up the share price of Sembcorp Industries and unloaded to retail investors for the past month.

We should not buy Sembcorp Industries at $1.80 now thinking of getting a good deal from the "free" shares or eyeing a great trading opportunity speculating on the EGMs to approve the recapitalisation and demerger plans. We should buy Sembcorp Industries at $1.80 now only if we believe in the profitability and resiliency of its energy and urban business in the long run, and as an additional bonus, there is a possibility of a future merger of some sort between Sembcorp Marine and Keppel O&M.

I am doing nothing and will wait for the demerger to pan out. I will consider cutting loss above $2.

Thanks for reading.

Love & Peace,

Qiongster

No comments:

Post a Comment