This is a quick update of my investment portfolios for this short month of February.

My SGX Income Portfolio value rises to $340k from $328k mainly due to capital injection for scooping up MPACT, CLCT and nibbling of DBS.

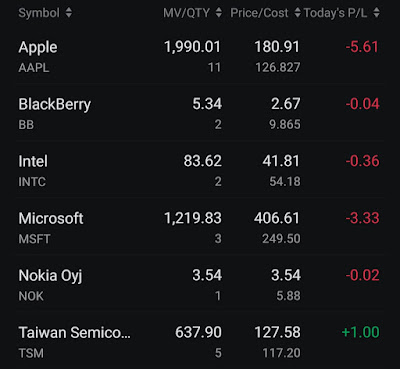

My US/HK Growth Portfolio value stagnates at US$17k.

My SRS Ultra Long-Term Portfolio value increases to $147k from $139k mainly due to my contribution of around $7.5k to SRS.

The US stock markets have attained fresh record highs before recent retracement, amidst uncertainties over interest rates, ongoing wars and diminishing fears of global recession. US 10-year and 30-year government yields have rebounded slightly and the Federal Reserve is expected to hold interest rates high for the short-term before cutting up to 6 times this year.

Despite being clouded by uncertainties, immense noises and fears, it is crucial that long-term investors like us always remain calm, unwavered and focused on our investment objectives. Stick to our own plan and continue deploying our financial resources into high quality income-producing instruments such as government-backed risk-free bonds, property assets, or strong growth businesses tactfully according to our own risk appetite.

I have gone on a shopping spree as I strongly believe in taking strides towards financial freedom by building up my passive income streams.

I have started contributing to my SRS account and has added more OCBC to my SRS portfolio. I have no plan to add US/HK stocks.

Portfolio Actions

Portfolio Dividends

1. Received $128.70 of dividends from Savings Bonds on 1 Feb.

2. Received $93.30 of dividends from Suntec Reit on 28 Feb.

3. Received $309.50 of dividends from Capitaland Ascott Trust on 29 Feb.

SGX Income Portfolio

Portfolio Value = $340k

Moomoo

Tiger Broker

Syfe Trade

SRS Ultra Long-Term Portfolio

Portfolio Value = S$147k

hi. may i know which broker you used for buying odd lots uob? thanks!

ReplyDeleteI am using POEMS by Phillips Capital to buy odd lots.

Delete