Today is the last day of Aug 2023, eve of presidential election holiday.

Time for some updates of my investment portfolios.

My SGX Income Portfolio value drops to $327k from $333k.

My US/HK Growth Portfolio value stagnates at US$15.4k.

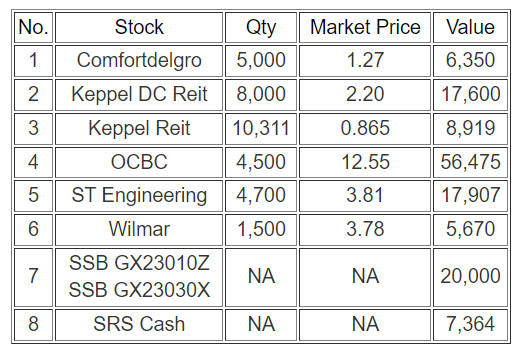

My SRS Ultra Long-Term Portfolio value dips to $140.2k from $141.8k.

The US stock markets have hit new highs on a strong bullish run despite lingering fears of global recession setting and more potential interest rate hikes by end of this year. As a result, local S-Reits tanked and just stabilised slightly in past days.

Despite being immersed by uncertainties, immense noises and fears, it is crucial that long-term investors like us stay calm, unwavered and make the best out of current situation by investing and deploying our financial resources into stable, high quality income-producing assets or growth businesses tactfully.

I plan to continue adding high quality S-Reits or local bank stocks to my SGX income portfolio in the next few months while also growing my cash in cash funds and risk-free Singapore Savings Bonds.

Portfolio Actions

Portfolio Dividends

1. Received $90 of dividends from Savings Bonds on 1 Aug.

2. Received $524.45 of dividends from UOB on 18 Aug.

3. Received $192 of dividends from DBS on 24 Aug.

4. Received $1,800 of dividends from OCBC in SRS on 25 Aug.

5. Received $222.24 of dividends from Ascott Reit on 29 Aug.

6. Received $86.95 of dividends from Suntec Reit on 29 Aug.

7. Received $90 of dividends from Wilmar in SRS on 30 Aug.

8. Received $157.80 of dividends from Ascendas Reit on 31 Aug.

9. Received $145 of dividends from Comfortdelgro in SRS on 31 Aug.

10. Received $188 of dividends from ST Engineering on 31 Aug.

11. Received $298.45 of dividends from IREIT Global on 31 Aug.

SGX Income Portfolio

Portfolio Value = $327k

Moomoo

Tiger Broker

Syfe Trade

SRS Ultra Long-Term Portfolio

No comments:

Post a Comment