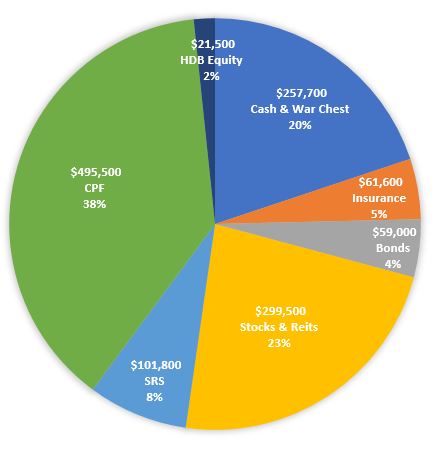

My net worth increases to $1.296m. On the brink of breaching $1.3m.

This is after collecting my July 2022 salary, Jun 2022 CPF contributions and more dividends from my SGX income portfolio and paying off all my credit card liabilities and bills.

I received a boost from the maturity of proceeds of an Great Eastern endowment plan purchased a decade ago. As a result, the portion of insurance drops to 5% and my cash war chest increases to 20% of my net worth.

I have completed SRS contribution of $15.3k, $8k RSTU of CPF SA account and $8k RSTU of my mum's CPF RA account for 2022.

For my SGX income portfolio, I have increased my investments by initiating a position in IREIT Global and adding Mapletree Commercial Trust for more dividends in future.

I plan to subscribe for the next few months of Singapore Savings Bonds, which should yield more than 3% on average for the next decade.

The coming months of year 2022 remains challenging and turbulent. Another round of 0.75% to 1% interest rate is on the cards of the Fed to curb immense inflation which could have already peaked. Global supply chain crunch, high oil prices and the Ukraine war have caused the prices of food and necessities to remain high. Prices of large items such as properties and cars continue to rise despite more costly mortgage loans. The stock markets remain volatile and unpredictable as to when is the bottom.

In such monetary environment, I still believe that Cash is King! Cashflow is also King! We should demand higher yields from banks, bonds, Reits and be more prudent with spending our monies. Continue making our monies work harder and own more income producing assets for more cashflow!

Life is great in an endemic world. Ignore the noises. Stay focused. Remain on track. Be greedy when others are fearful. We will get to our goals and dreams eventually.

Congrats! Are you contributing to SRS mainly for tax relief?

ReplyDeleteThanks. I contribute to SRS for tax relief and to invest in strong profitable local companies such as OCBC, ST Eng, Wilmar etc. for the long-term using SRS funds.

DeleteHow old are you by the way! To get a gauge when one should be in terms of age and having this kind of savings and network. Many thanks

ReplyDeleteI am mid 30s. As everyone runs his or her own race in the financial journey, works in different industry, has different risk appetite, it is not meaningful to compare with others. The richest folk may not be the happiest and the poorest folk may not be the saddest.

Delete