Today is the second last day of July 2022 and it is time for me to update my investment portfolios.

The stock markets have rebounded after months of volatility and uncertainty under the immense noises engulfing Fed tapering, interest rates hikes, inflation fears, recession fears, pandemic fears, rise of US Treasury yields, Ukraine war, poor company quarterly results and so on.

Whether it will stay as a new bull uptrend or merely just a fake breakout remains uncertain. Nevertheless, time in the market always beats timing the market. Every market tank leads to a rebound, stronger than ever before.

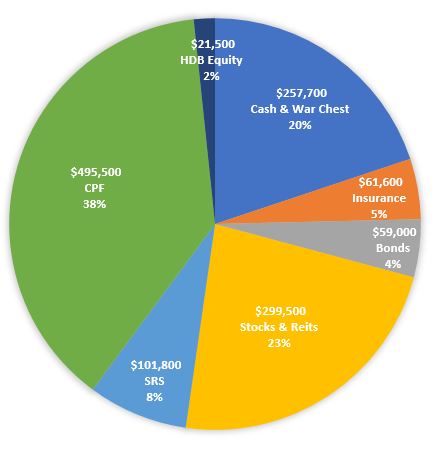

I remained focused and steadfast in my pursuit of financial freedom quest. I have started to deploy some of my war chest in S-Reits and US growth stock while dabbling with options for fun.

I have also channeled idle cash into money market funds in Philip Money Market Fund, Fullerton Cash Fund in Moomoo and Singapore Savings Bonds to let my monies work hard to generate yield from 1% to 3% respectively.

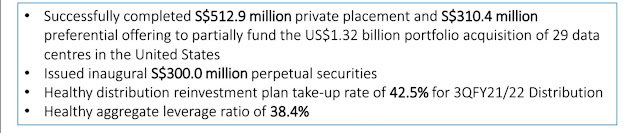

My SGX Income Portfolio value increases to $292.50k from $268.9k last month mainly due to the share price recovery of many of the S-Reits which are now cum dividend mode after announcing their 2Q 2022 or 1H 2022 financial results. Furthermore, I injected capital of around $14k to add Mapletree Commercial Trust during the preferential offer period and initiated position in IREIT Global.

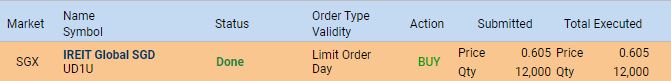

1. Bought 12,000 shares of IREIT Global at $0.605.

2. Bought 4,000 shares of Mapletree Commercial Trust at $1.78.

3. Rolled down 1 unit of BAC Put Option by closing BAC220715 put option with $31 strike price at US$118 and sold BAC221216 put option with $26 strike price at US$138.

4. Sold 2 units of PLTR Call Options PLTR220812 with $11 strike price at US$25.

5. Bought 20 shares of Alphabet Inc. (NASDAQ:GOOGL) at $106.30.

Portfolio Dividends

1. Received $117.50 of dividends from Savings Bonds on 1 Jul.

SGX Income Portfolio

SRS Ultra Long-Term Portfolio

Thank you for reading. As always, invest safe and remain focused as always.