The 3 Singapore banks - DBS Group Holdings Limited (SGX:D05), Oversea-Chinese Banking Corporation Limited (SGX:O39) and United Overseas Bank Limited (SGX: U11) have their share prices recovered to pre-pandemic levels, reflecting the optimism in their future earnings leveraging on Singapore's economy growth and underpinned by higher interest rates.

As an investor, I would love to invest in banks when they are undervalued and dragged down by bad news than during an economic recovery now.

Ever since my last purchases in OCBC and UOB in 2020, I have been on the sidelines waiting for opportunity for their share prices to correct and offer value but to no avail.

I ponder if it is possible to find value in foreign banks that offer dividends and are as strong and stable as our local banks.

Besides the 3 local banks, the top 2 foreign banks with local presence felt are Stanchart and Citibank.

Standard Charterted PLC (LON:STAN) is listed on the London Stock Exchange which I have no access to and not interested to invest in. Citigroup Inc (NYSE:C) is listed on New York Stock Exchange which is readily assessable through many brokerages hence I am curious to find out if it is worth investing in.

Below is a quick analysis I did up to have a rough gauge and may not be accurate hence take it with a pinch of salt.

Compared to the 3 local banks which are worth more than their book values, Citigroup Inc. only has a P/B ratio of 0.71.

P/E ratio of Citigroup Inc. is much lower than the 3 local banks.

PEG ratio of Citigroup is comparable to UOB and lower than DBS and OCBC. PEG ratio lower than 1 means that the stock price is fairly or undervalued factoring future earnings growth of a company. PS: The 3 local banks may not be that expensive after all!

The actual dividend yield of Citigroup Inc. of 3.09% is comparable to the 3 local banks however there is a 30% tax on dividends from US stocks hence the net dividend yield is only 2.1%.

Market cap of Citigroup Inc. is larger than the 3 local banks and more than double OCBC and UOB. It is a top 10 largest bank in the world and top 5 largest bank in the US.

Conclusion

With the above analysis, I find Citigroup Inc. undervalued and worth investing into even though it is the only American bank which Warren Buffett does not invest.

Its share price is cheap to compensate for greater uncertainties and risks due to the bank having a new management and undergoing corporate transformation. It has announced plans to exit or sell its consumer banking business and may not go well with investors. The bank has also been facing regulatory challenges and internal problems, getting fined by regulatory bodies over operational mistakes and poor risk controls by their bankers, and sometimes getting into lawsuits over blunders.

Investing comes with risks and the banking business has always been challenging and risky. Even our local bank OCBC has 470 customers losing at least S$8.5m to scammers and tainted its reputation a little but not affecting its share price at all.

The reward to risk ratio of investing in Citigroup Inc. is quite reasonable as investors could get paid 2% dividends while waiting for its value be unlocked in the long-term.

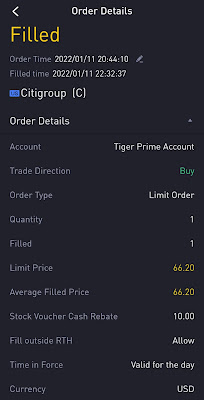

As I have stock and commission vouchers in my Tiger Broker account, I decided to utilise it to nibble a Citigroup Inc. share.

There it goes. US$10 rebate with free commission.

If you are interested to kick-start your journey in stock investing in HK or US markets, do use my referral link to register for a Tiger Broker account, fund it with at least S$2k to get a free apple share worth US$170 and 60 commission-free trades for 180 days.

This comment has been removed by a blog administrator.

ReplyDelete