Over the past decades, OCBC Bank (OCBC SGX:O39) has demonstrated remarkable resilience and financial strength, navigating economic challenges with aplomb. Despite its robust performance, the stock's valuation has remained relatively subdued compared to its peers and historical averages. Even after hitting all-time high at above $15.40, there is still an intriguing question: Is OCBC currently over, fairly or undervalued, presenting a compelling investment opportunity?

Fundamental Strength and Resilience

OCBC's strong financial foundation is a cornerstone of its investment appeal. The bank boasts a healthy capital adequacy ratio, well above regulatory requirements, ensuring its stability and ability to absorb potential shocks. Moreover, OCBC has consistently maintained a low non-performing loan (NPL) ratio of 1%, reflecting prudent risk management practices and a high-quality loan portfolio.

The bank's diversified business model, spanning across multiple geographies and product lines, further enhances its resilience. OCBC's presence in key Asian markets, including Singapore, Malaysia, Indonesia, and Greater China, provides a balanced exposure to diverse economic cycles. This geographic diversification mitigates risks and supports sustainable growth.

Earnings Growth and Dividend Prospects

OCBC has a history of delivering consistent and steady earnings growth, driven by its strong market position, disciplined cost management, and strategic investments. The bank's ability to generate sustainable profits positions it favorably for future growth and shareholder returns.

OCBC reported a record net profit of S$3.93 billion for the first half of 2024, marking a 9% increase year-on-year, driven by significant income growth across its banking and wealth management sectors.

Moreover, OCBC has a track record of rewarding shareholders through regular dividends. The bank's dividend payout ratio is typically prudent, ensuring a sustainable dividend policy while preserving capital for reinvestment and growth initiatives. This combination of earnings growth and dividend income makes OCBC an attractive investment for both income-seeking and growth-oriented investors.

The interim dividend was raised by 10% to 44 cents per share, reflecting the bank's commitment to returning value to shareholders while maintaining a healthy payout ratio of 50%. Assuming OCBC can maintain its 88 cents annual dividends, its yield is easily more than 5.5% at current price of $15.32, which is very attractive as yields of lower risk financial instruments fall.

Robust Capital Position

OCBC's robust capital position is a key pillar of its financial strength, highlighted by a Common Equity Tier 1 (CET1) ratio of 15.5%, significantly above regulatory requirements and higher than its peers higher than its peers, such as DBS at 14.7% and UOB at 13.4% as of Q1 FY2024. This strong capital base, along with a total capital adequacy ratio of 17.9% and a low non-performing loan (NPL) ratio of 1%, reflects effective risk management and sound asset quality. Such resilience allows OCBC to absorb potential losses while pursuing strategic growth initiatives, including its recent acquisition of Great Eastern Holdings.

Moreover, OCBC's proactive approach to capital management ensures that it is not merely hoarding capital but strategically deploying it where it can generate the most value. With a solid liquidity coverage ratio and a focus on acquiring stable deposits, OCBC is well-positioned to navigate market challenges and capitalize on emerging opportunities in the financial sector. This combination of strong capital ratios and effective risk management reinforces investor confidence in OCBC as a stable and growth-oriented investment.

Strategic Acquisition of Great Eastern

OCBC has made a significant $1.4 billion bid to take Great Eastern private, acquiring the remaining 11.56% stake it does not already own. This offer, priced at S$25.60 per share, represents a 36.9% premium over the last traded price prior to the announcement. The acquisition aligns with OCBC's long-term strategy to strengthen its wealth management and insurance sectors, which are crucial in a region experiencing rising demand for financial products.

The acquisition is expected to be earnings accretive for OCBC, allowing the bank to optimize its capital and enhance shareholder returns. By consolidating its insurance operations under one umbrella, OCBC can improve operational efficiencies and better serve its customer base through integrated financial solutions.

Unlocked Value

OCBC Bank has strategically cultivated a substantial real estate portfolio, comprising a diverse range of properties, including prime shophouses in Singapore. These properties serve as valuable assets that contribute to the bank's overall financial strength and stability.

OCBC's shophouses are often located in highly desirable and prime areas of Singapore, such as the Central Business District (CBD) and Orchard Road. These prime locations benefit from high foot traffic, strong rental demand, and robust property appreciation potential.

OCBC's real estate portfolio generates a steady stream of rental income, contributing to the bank's recurring revenue and supporting its operations. As property values appreciate over time, OCBC's real estate holdings become more valuable, enhancing the bank's overall financial strength and providing a buffer against potential losses in other areas of its business. OCBC's real estate assets can also serve as collateral for loans and other financial obligations, providing additional security and reducing the bank's risk exposure.

What is important to note is that OCBC Bank, like many financial institutions, records its assets, including many of their real estate portfolio at cost. This means that the initial purchase price or fair value at acquisition is the basis for recording the asset on the bank's balance sheet. This means that their actual asset value is understated conservatively. Should one day OCBC decides to listing their properties as OCBC Reits, the hidden value will be unlocked!

Healthy valuation

As of June 2024, OCBC's book value per share is reported at S$12.66. With the current share price of approximately S$15.30, this results in a price-to-book (P/B) ratio of about 1.2. This indicates that OCBC is trading at a slight premium to its book value, which is typical for established banks that possess strong earnings potential.

According to Gurufocus, OCBC's intrinsic value projected based on future free cash flows is $15.45. According to value investing.io, the intrinsic value is much higher at $19.10. By Alphaspread standards, the intrinsic value is even higher at $20.36. Simplywall.st generously valuates OCBC's fair value at a whopping $39.19, on par with DBS current share price.

In terms of target prices, the analysts from brokerages have expressed positive views on OCBC's prospects, citing its strong fundamentals, attractive valuation, growth potential and projected a range from $14.90 by DBS Research, $15.40 by Maybank Securities, $16.70 by CGSI Research, $17.01 by Maybank Research, to $19.40 by UOB Kay Hian in the next 12 months.

Logically if the dividend yield of OCBC is compressed to 4% as more investors shift their cash from declining Fixed Deposit, T-Bill and money market funds into bank equities, the share price of OCBC is $22! Personally, I believe there is still plenty of headroom for OCBC share price to soar higher.

Will I buy more OCBC shares at $15.32?

As OCBC focuses on sustainable growth rather than short-term dividends, the bank is strategically and well positioned for future opportunities in a rapidly evolving financial landscape. The bank’s commitment to enhancing its wealth management capabilities through the Great Eastern acquisition reflects a forward-thinking approach that could yield significant returns in the long run.

Buying OCBC shares at $15.32 not only offers exposure to a well-capitalized bank with strong earnings potential but also aligns with a strategic vision that prioritizes long-term growth and stability in an increasingly competitive market.

Additionally, several potential catalysts could further drive OCBC's stock price in the coming months and years. These catalysts include continued economic recovery in China, Hong Kong and Asia, favorable regulatory developments, and successful execution of the bank's strategic initiatives.

While no investment is without risk. OCBC's strong fundamentals, attractive valuation, and growth prospects make it a compelling investment opportunity. The bank's resilience, diversified business model, and track record of delivering shareholder value position it favorably for long-term success.

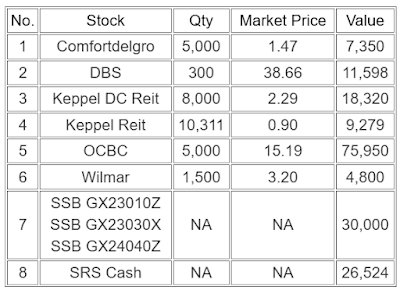

I currently own 5,000 shares of OCBC in my SRS account at a net cost of only $8.32 after lessing off the past dividends collected. As my recent T-Bill applications were unsuccessful, I am seriously contemplating buying more OCBC shares at current prices but my bargain instincts and technical analysis will influence me to place an order slightly near the 100 MA support at $14.80 to slightly below $15 instead.

OCBC will be announcing its Q3 2024 financial results on 8 Nov morning. I think the results will be positive but I hope the results will be below expectation so that their share price will correct for us investors to buy at lower costs.

Investors seeking undervalued stocks with strong growth potential and a history of rewarding shareholders could consider OCBC as a potential addition to their portfolios. However, it is essential to conduct thorough due diligence and consider individual risk tolerance before making any investment decisions.

On the back of macroeconomic factors such as economic recession fears, global political landscape uncertainties and interest rate noises, the share price of OCBC may be very volatile, correct healthily or tank any time as we have witnessed in the past.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.

Thank you for reading.

With love & peace,

Qiongster