This is a quick update of my investment portfolios on the last day of Nov 2023.

My SGX Income Portfolio value rebounds to $316k from $301k.

My US/HK Growth Portfolio value rises to US$17 from US$16k.

My SRS Ultra Long-Term Portfolio value inches up to $137.4k from $136.4k.

The US stock markets have hit new heights amidst increasing certainty of pivoting interest rates, ongoing wars and lingering fears of global recession. US 10-year and 30-year government yields have retraced from record highs and the Federal Reserve is expected to maintain interest rates steady at the 5.25 to 5.5% range till 2024. Local S-Reits have rebounded and stabilised slightly helping my SGX Income Portfolio recover back some paper losses.

Scary storylines about economies, monetary policies and geopolitical tensions just keep repeating, causing chaos and fear amongst investors and traders While being clouded by uncertainties, immense noises and fears, it is crucial that long-term investors like us stay calm, unwavered and focused in our investment objectives. Make the best out of current situation by allocating our financial resources into high yield risk-free bonds, stable and high quality income-producing assets, or strong growth businesses tactfully.

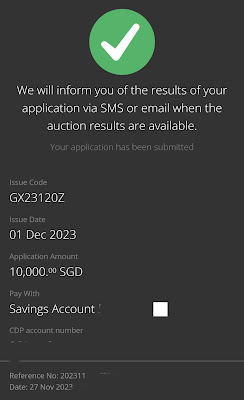

I will continue stashing away idle cash in high yield cash funds and risk-free Singapore Savings Bonds while also adding high quality S-Reits or local bank stocks to my SGX income portfolio if opportunities arise in the next few months. I have no plan to add US/HK stocks.

Portfolio Actions

Portfolio Dividends

1. Received $428.35 of dividends from Savings Bonds on 1 Nov.

2. Received $270.00 of dividends from Guocoland on 16 Nov.

3. Received $192.00 of dividends from DBS on 27 Nov.

4. Received $187.15 of dividends from Astrea 7 A-1 PE Bond on 27 Nov.

5. Received $481.60 of dividends from Frasers Centrepoint Trust on 29 Nov.

6. Received $89.65 of dividends from Suntec Reit on 29 Nov.

SGX Income Portfolio

Portfolio Value = $316k

Moomoo

Tiger Broker

Syfe Trade

US$0.9kSRS Ultra Long-Term Portfolio

Portfolio Value = S$137.4k