Today is the last day of Feb 2023.

Let me provide a quick update of my investment portfolios.

My SGX Income Portfolio value drops to $296k from $304k last month.

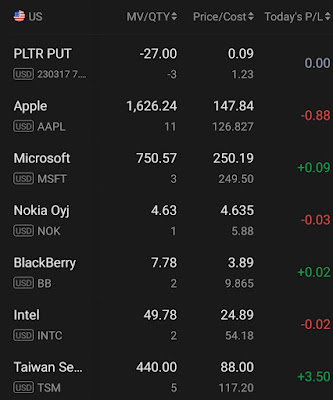

My US/HK Growth Portfolio value dips to US$14.1k from US$14.7k last month.

My SRS Ultra Long-Term Portfolio value rises slightly to $124k from $120k due to recent contribution of $6.8k into my SRS account.

The Fed will slow down interest rate hikes and global recession is on the cards. The stock markets have displayed signs of retracement despite earlier bullish trend amidst immense volatility in a high inflationary environment still clouded by immense noises and fears. We should remain calm and clear-minded and make the best out of current situation by investing and deploying our financial resources into assets tactfully in 2023.

1. Rollover 1 unit of GOOGL230203 call option with $95 strike price by closing at $10.30 and sold 1 unit of GOOGL230616 call option with $100 strike price at US$11.85.

Portfolio Dividends

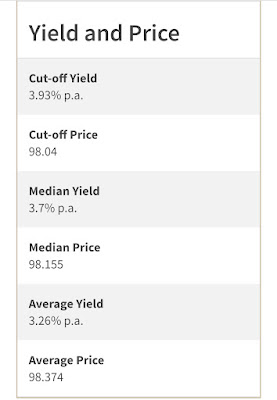

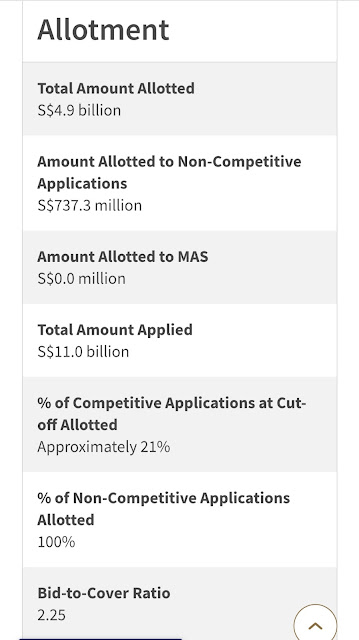

1. Received $90 of dividends from Savings Bonds on 1 Feb.

2. Received $99.50 of dividends from Suntec Reit on 28 Feb.

SGX Income Portfolio

Portfolio Value = $296k

Moomoo

Tiger Broker

Syfe Trade

Portfolio Value = US$14.7k

SRS Ultra Long-Term Portfolio

Portfolio Value = S$124k