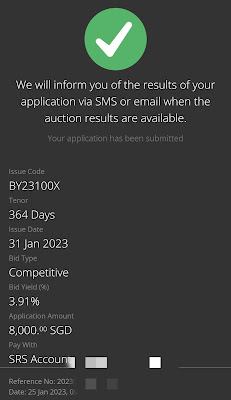

I just topped up $8k into my mum's CPF Retirement Account today.

Let me reiterate 5 reasons why I did so instead of giving cash to her.

1. Tax Relief

For selfish reason, I would like to enjoy tax relief of up to $8k per calendar year for topping up my parent's CPF Retirement Account under the Retirement Sum Top Up (RSTU) scheme.

Assuming my tax bracket is at 11%, a relief of $8k will save me $880 of taxes in cash, which is enough to eat more than 100 plates of $4 cai png (vegetables rice) at the coffeeshop.

The tax relief is also applicable to family members such as parents-in-law, grandparents, grandparents-in-law, siblings and spouse.

2. Compounding growth at 4%

CPF Retirement Account yields at least 4% and up to 6% for senior folks risk-free and guaranteed by the Singapore Government. Monies growing at compounded rate of at least 4% will double in 20 years hence, by leaving cash in CPF RA account, they will grow much faster than inflation rate to preserve and uphold its real value.

3. CPF Life

In order to qualify for CPF Life, one need to have at least $60k in their CPF retirement savings before reaching 65 years old. I am helping my mum to boost her CPF retirement savings to qualify for CPF Life as she does not have active income and CPF contributions.

CPF Life offers payouts perpetually for life but is a debatable subject because its pros and cons varied across individuals' opinions. If one's CPF RA does not have $60k before reaching 65 years old, then he or her will only rely on Retirement Savings scheme to draw down their CPF savings till it is depleted.

Having at least $60k in CPF RA will offer extra choice of being able to qualify for CPF Life scheme to enjoy perpetual monthly payouts.

4. Matched Retirement Savings Scheme

Under the Matched Retirement Savings Scheme (MRSS), the Government will match every dollar of cash top-ups made to the Retirement Account of eligible members up to a cap of $600, which can amount to $3,000 over 5 years. To be eligible, the person has to be aged between 55 and 70, has a CPF RA of less than the current Basic Retirement Sum of $96k, has average monthly income of less than $4k, live in a property with annual value less than $13k and not own any private property.

By topping up at least $600 to a qualified family member's CPF RA account, we can milk the $600 of free money from the Government every year.

5. CPF is like golden ATM for senior citizens

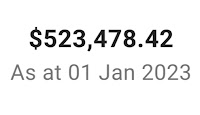

For senior folks close to reaching the 55 year old and 65 year old milestones of being able to touch their CPF monies, their CPF accounts are like golden ATM that offer high interest rates for "withdrawable" cash with the click of a button. This is unlike younger folks who could only stare at their CPF balances as numbers. Hence, the concept of 1M65 is indeed beneficial and practical to people who could really live beyond 50s or 60s and on the brink of drawing down cash from their CPF balances. People who lived past 50 years old should try to pump more monies into their CPF accounts, by all means, in order to reap the risk-free guaranteed returns on their monies.

In conclusion, I top up my mum's CPF RA account with cash instead of giving cash, in order to maximise the value of money. For the $8k topped up, I can enjoy $880 of tax savings myself, let my mum earn at least $280 of CPF interests for 2023 and attract another matched $600 from the Government. In addition, there is compounding effect from future years' interests and being eligible to qualify for CPF Life for perpetual monthly income payouts. Overall, I feel that it is an awesome deal.

Thanks for reading. Stay focused and remain steadfast as always!

With love & peace,

Qiongster