One year ago, I dabbled in cryptocurrencies for the first time.

I mentioned that "I am excited to begin this journey into Crypto. The excitement is like stepping into a Casino."

After barely one year, time has proven me right as we witnessed the crash of Luna, fall of FTX and contagion domino effects on other crypto exchanges and meltdown of cryptocurrencies.

Although I am disheartened by many crypto investors losing huge amounts of their heart-earned fiat and cryptocurrencies, and despite personally losing more than 80% of my paltry $500, I believe there are valuable takeaways from this meltdown and this is a good wake-up call.

Let me share the 5 great lessons learnt.

1. Fundamentals are important in any investment

Unlike national currencies backed by a country's cash reserves, cryptocurrencies are not backed by any government, country or underlying fundamentals. Traditional debt market fundamentals or stock valuation techniques all do not apply. Cryptocurrencies are purely priced based on hype, irrational human greed and emotions. Decentralised finance is unregulated and not subjected to any international nor monetary law. There are high risks and low financial security in owning such digital assets despite great transparency, immutability and authenticity in the underlying promising blockchain technologies upon which such cryptocurrencies thrive.

2. Decentralized Finance and BlockChain still have potential

DeFi and BlockChain are still promising technologies with great potential for many real-world use case applications such as in the realm of smart contracts, Internet-of-Things, personal identity security, healthcare, logistics, non-fungible tokens. Crypto is just one use digital currency application use case which hits hardly during its bad times now. During its boom time, cryptos created many millionaires and billionaires effortlessly though. It is still premature to conclude that cryptocurrencies are failure. This is not the end of crypto and perhaps only the beginning.

3. Portfolio risk management

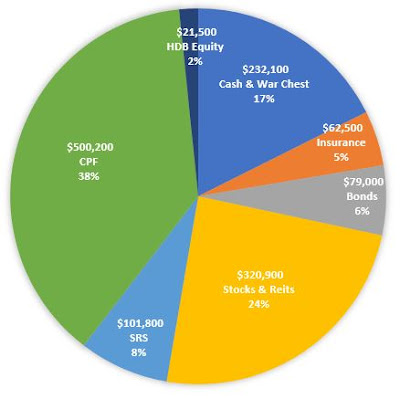

Like any investment strategy, we have to manage our risks and allocate our financial assets by diversifying and not put all eggs in one basket. It is too high of a risk to stomach if we invest too large amounts of monies in risky cryptocurrencies. We should only risk what we can afford to lose, say 5 to 10% of our net worth only.

4. Leverage for risky assets is No-No

A mortgage for an appreciating assets such as property is a healthy leverage. Using margin or overleveraging to purchase and own cryptocurrencies is a big no-no. While the returns can potentially be very high, the losses are too hard to stomach. This is akin to gambling by playing with blackjack or Russian Roulette in a casino. Leveraging is an all-or-nothing punting strategy.

5. Avoid herd mentality

Fear of missing out and herd mentality lead to many of us commoners on the streets hopping on the crypto wave. There is no free lunch in this world. If investing in cryptocurrencies can make every investor a billionaire, then all casinos, bankers or lottery shops would have closed by now. Those who fly alone have the strongest wings. Those who walk alone have the strongest directions. It is sometimes better to be a contrarian and make our own diligent judgement instead of relying on the decisions of the masses.

Just offering my two cents on a lazy Sunday afternoon. Thanks for reading.

With love & peace,

Qiongster