It is time to update my investment portfolios on the last day of August 2022.

The stock markets remained volatile and uncertain under the immense noises engulfing Fed tapering, interest rates hikes, inflation fears, recession fears, pandemic fears, rise of US Treasury yields, Ukraine war, poor company quarterly results and so on.

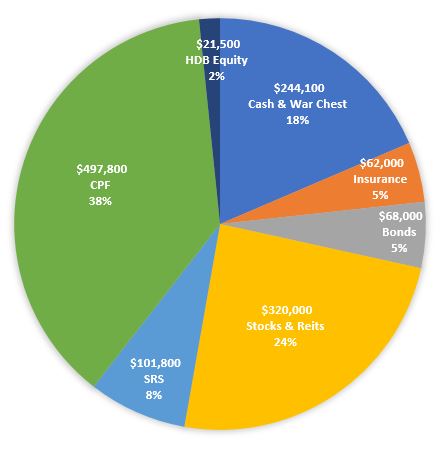

I stay unswayed and steadfast in my pursuit of financial freedom quest. I am on standby to deploy more of my war chest in S-Reits and US growth stock while collecting option premiums for fun.

My idle cash remains in fixed deposits and money market funds such as Philip Money Market Fund, Fullerton Cash Fund in Moomoo and Singapore Savings Bonds generating average yields of above 2%.

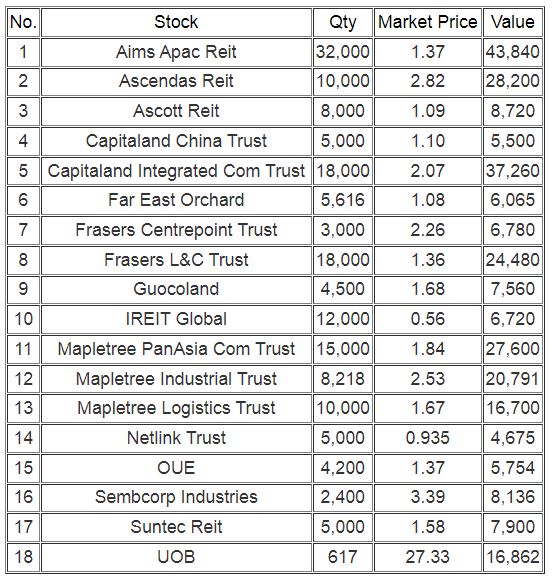

My SGX Income Portfolio value falls to $283.5k from $292.5k last month mainly due to fears about more interest rate hikes by the Fed to curb inflation, and post XD weakness of the share prices of most Reits.

Nil

Portfolio Dividends

1. Received $370.20 of dividends from UOB on 22 Aug.

2. Received $96 of dividends from Sembcorp Ind on 23 Aug.

3. Received $90 of dividends from Wilmar on 24 Aug in SRS.

4. Received $456 of dividends from Mapletree Pan-Asia Com Trust on 25 Aug.

5. Received $960.12 of dividends from OCBC on 25 Aug in SRS.

6. Received $186.56 of dividends from Ascott Trust on 29 Aug.

7. Received $120.95 of dividends from Suntec Reit on 29 Aug.

8. Received $213 of dividends from Comfortdelgro on 29 Aug in SRS.

9. Received $307.42 of dividends from Keppel Reit on 29 Aug in SRS.

10. Received $233.50 of dividends from IREIT Global on 31 Aug.

SGX Income Portfolio

SRS Ultra Long-Term Portfolio

Thank you for reading.