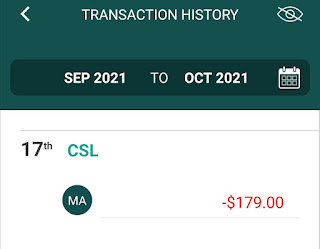

I have been nibbling 99 shares of CICT daily since 17 Sep 2021.

Let me provide 5 reasons why I did and will continue to do so until 15 Oct 2021.

1. Zero Brokerage

Due to the restructure of Capitaland, currently there is a zero brokerage promotion for trading CICT odd lots and CLI odd lots on Phillips Capital. POEMs platform.

As a cheapo, I like to enjoy free brokerage.

2. Share price near book value

The share price of CICT has been weak in recent weeks since the restructure of Capitaland and surge of virus cases in Singapore affecting the retail and commercial scenes once again.

The book price of CICT is around $2.055. Hence I would not mind paying close to its actual book value in this period when its share price fluctuate between $2.00 and $2.10.

However, if the support at $2 is broken, we could see further downside for CICT. As a long term investor, I am not too concerned about short-term volatility, but rather focus on long-term passive income.

3. Reinvest passive income to compound more passive income

I have collected around $3k of dividends (CICT contributed more than $800) in cash recently and would like to reinvest them to let compounding effect take place to generate more passive income in the future.

With the absence of scrip dividend reinvestment for CICT and this brokerage free promotion, I decided to create my own scrip dividend reinvestment.

4. Uncertainties provides opportunities

CICT is the largest Reit in Singapore by market capitalization as of 30 Sep 2021 and also the 3rd largest Reit in Asia. It owns all many popular shopping malls and Grade A commercial properties in the downtown of Singapore.

I believe in adding shares or increasing investment in every dip or correction. We buy shares or invest when there are bad news and uncertainties, rather than when things are going well and we pay inflated prices for shares.

I yearn and like to increase my stakes in a quality Reit such as CICT in times of uncertainties and when the retail scene is adversely affected by the pandemic.

5. Dollar Cost Average for fun

To purchase 99 shares of CICT everyday, I need to place my daily orders at the "correct" price that I think will get my orders filled. It is a good test of my speculation instinct.

It is very fun and exciting to speculate the lower end of CICT for the next day and I would usually place my order for the next day at then end of a preceding trading day.

I get to experience dollar cost average of purchasing the same underlying asset at different prices everyday throughout 4 weeks using my real money and it beats trading any demo paper account.

Conclusion

I own 16,000 shares of CICT before starting this nibbling and target to add on 2,000 shares through this promo without incurring any brokerage fee, though other small transaction fees still apply.

As of the time of writing, I own 17,188 shares of CICT after adding 1,188 shares through this promo.

Though the odd lots counter is more illiquid than the main counter, I am happy to get my orders filled everyday.

May the nibbling spree continues.

Thanks for reading. As always, stay safe and remain strong.

With love & peace,

Qiongster