T Tower, a freehold 28 storey office building in Jung-gu, Seoul, South Korea owned 99.4% by Keppel Reit

Keppel Reit (SGX: K71U) reported its 2Q 2020 Results on 20 July 2020.

Key Highlights:

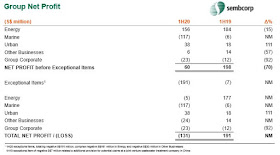

a. Net property income declined 7.2%

b. Distribution income increased 0.4% due to capital gains of $5m

c. DPU for 2Q inched up 0.7% to 1.4 cents Year-on-Year

d. Gearing ratio is at 36.3% and all-in interest rate reduced to 2.48% per annum

e. Occupancy rate is high at 98.6%

f. Commencement of 30-year lease for Victoria Police headquarters at 311 Spencer Street, Melbourne

Source: Keppel Reit 2Q Results Announcement

The acquisition of T Tower, Seoul in Apr 2019 helps to cushion the impact of income loss for the sale of Bugis Junction Towers in Nov 2019.

The support measures by Singapore Government help to cushion the impact of Covid-19 health pandemic on the property income as 4.7% of local tenants have received relief to offset their rental payments totalling $9.2m. In Australia, 1.2% of the SME tenants received rent waivers and deferrals from the Australian government. In South Korea, none of the tenant qualify for any relief measures.

Keppel Reit has also allowed $1.6m of rentals to be deferred.

The occupancy rate remains high at 98.6% and the property portfolio has a decent WALE of 4.6 years. There is also slight positive rental reversion from the leases renewed in 1H 2020 at an average signing rent of $11.86 psm above expiring rents of $10.45 psm. There are only 2.2% of the leases expiring for the remainder of 2020.

This will be the last quarterly DPU for Keppel Reit as the manager has adopted half-yearly reporting for next half onwards. So the dividend payout for 2H 2020 will be in 2021.

Moving Ahead

The new normal of working from home due to the Covid-19 health pandemic will pose an impact to occupancy risk and may result in further negative rental reversions for Keppel Reit even though there will be lower supply of office space in Singapore for the next few years. Many tenants will review the need to occupy the same office space. Struggling tenants who fail to survive may contribute to increased occupancy rate. Depreciation in AUD and KRW would result in lower contributions from the properties in Australia and South Korea. Hence, I would expect NPI and DPU of Keppel Reit to take a slight hit in the short to mid term.

Honestly, Keppel Reit has not been doing well over the past few years due to declining net property income, falling DPU and high management fees. But what I like in Keppel Reit is its best-in-class office skyscraper portfolio comprising of Grade A offices in the prime CBD of Singapore such as the likes of One Raffles Quay, Marina Bay Financial Centre and Ocean Financial Centre. T Tower in Seoul, with a freehold tenure, seems to be a shrewd tactical acquisition for geographical diversification and stabilisation of recurring property income. The completion of 311 Spencer Street as a HQ for the Victoria police in Australia further helps to provide another source of consistent stable recurring income for the next 30 years.

Keppel Reit will be the only local pure play office Reit left on SGX after the merger of Frasers Commercial Trust with Frasers Logistics & Industrial Trust, OUE Commercial Trust with OUE Hospitality Trust and the upcoming merger of Capitaland Commercial Trust with Capitaland Mall Trust. Who knows if Keppel Reit will be merged with Keppel DC Reit or being acquired by Blackrock or Keppel Land in the future?

It is currently undervalued at a market price of $1.09 and priced at 0.8x to book value of $1.33. At an estimated DPU of $0.055 cents per annum, its yield is 5%.

I am vested at an average holding cost of $0.82 with a yield of 6.7% and enjoying a decent margin of safety. Hence I will not consider selling my Keppel Reit shares at below book value of $1.33 even though I am not particularly pleased with its performance over the past few years.

Thanks for reading.

Love & Peace,

Qiongster